Selling your pain management practice is one of the most significant financial and professional decisions you will ever make. For owners in Kansas, the current landscape presents a unique window of opportunity, driven by strong demand and increasing buyer interest. This guide provides a clear overview of the market, key considerations for maximizing your practice’s value, and the steps involved in a successful transition. Navigating this path correctly is the key to securing your financial future and professional legacy.

Market Overview: A Strong Climate for Kansas Sellers

The current environment for pain management is robust. On a national level, the market is expanding, and this growth is mirrored by specific trends within Kansas. A significant portion of adults in the state, about one-quarter, live with chronic pain. This creates a consistent and growing patient base that makes your practice fundamentally valuable.

This is not just about patient demand. It is also about buyer demand. An aging U.S. population ensures that pain management services will remain a critical part of the healthcare system for decades to come. This long-term stability makes practices like yours highly attractive to a range of buyers who are looking for sound investments. This combination of steady patient need and strong buyer interest creates favorable conditions for practice owners considering a sale.

Key Considerations for Your Practice

A strong market is a great starting point, but a successful sale depends on the specific health of your practice. Buyers will look closely at several areas. Preparing them in advance is not just good practice. It directly impacts your final valuation. Here are the areas that demand your focus.

Financial Health

This goes beyond simple revenue. Buyers want to see clean, consistent financial records with clear trends in revenue and profitability. They will analyze patient volume, procedure mix, and facility fee revenue. If your books are messy or your profitability is unclear, it creates uncertainty and risk for a buyer, which lowers their offer. We find that starting this cleanup process 1-2 years before a potential sale yields the best results.

Operational Readiness

How reliant is the practice on you, the owner? A practice with multiple providers and well-defined operational systems is more valuable than one that would collapse if you left. Buyers are acquiring a business, not just a job. Documenting your processes and empowering your team demonstrates a scalable, turnkey operation.

Kansas Compliance

Every state has its own rules. In Kansas, the Board of Healing Arts has specific guidance on structuring healthcare businesses. Navigating change of ownership filings and other regulations requires know-how. It is wise to seek advice from professionals who are familiar with Kansas healthcare law to ensure your transition is smooth and compliant.

Market Activity: The Rise of Strategic Buyers

The landscape of potential buyers for medical practices has changed. While a sale to another local physician is still an option, a major trend is the increasing interest from private equity (PE) groups and larger strategic platforms. These are sophisticated buyers actively acquiring pain management practices to build regional and national networks.

For a Kansas practice owner, this is significant. These buyers often have access to more capital and may be able to offer premium valuations for practices that fit their strategic goals. They are not just buying your past performance. They are buying your future potential as part of a larger organization. Selling to a strategic partner is a different process than a simple practice sale. It requires a professional approach to ensure you are positioned correctly and can negotiate from a position of strength. The presence of these buyers is a primary reason why the current market holds so much potential for a well-prepared practice.

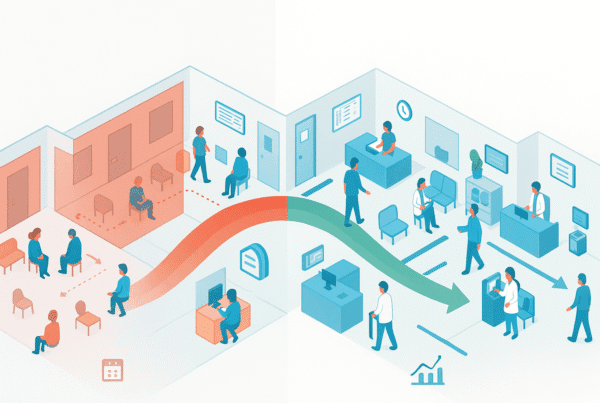

The Sale Process: A Structured Path to Closing

A successful practice sale does not happen by chance. It follows a structured process designed to protect your confidentiality, create a competitive environment among buyers, and minimize disruptions to your practice. While every sale is unique, a professional M&A process generally follows these phases.

| Phase | Key Objective | Why It Matters |

|---|---|---|

| Phase 1: Preparation & Valuation | Establish a defensible valuation and prepare marketing materials. | This is the foundation. A strong start based on a thorough valuation prevents leaving money on the table. |

| Phase 2: Confidential Marketing | Identify and approach a curated list of qualified buyers discreetly. | Protects your privacy and reputation. Prevents your staff, patients, and competitors from knowing you are exploring a sale. |

| Phase 3: Buyer Negotiation | Field initial offers (Letters of Intent) and negotiate key terms. | Creates competitive tension, which is the best way to drive up the price and improve terms like cash at close. |

| Phase 4: Due Diligence & Closing | The selected buyer verifies all financial and operational details. | This is where deals often face challenges. Proper preparation from Phase 1 makes this step a smooth confirmation, not a risky hurdle. |

Navigating these stages, especially the due diligence phase, requires experience. It is where a prepared seller with expert guidance can maintain momentum and close the deal on favorable terms.

Valuation: What Is Your Practice Really Worth?

Understanding your practice’s value is step one. Sophisticated buyers value a practice based on its true, sustainable profitability. This is often represented by a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This is not the same as the net income on your tax return.

We calculate Adjusted EBITDA by taking your stated profit and “normalizing” it. We add back owner-specific personal expenses run through the business or an above-market owner’s salary. For example, if your practice shows $500k in profit but you pay yourself $150k more than the market rate for a physician, a buyer sees that as $650k in true practice profitability. This adjusted number is then multiplied by a market-based multiple to determine the Enterprise Value. This multiple is influenced by your specialty, scale, and provider mix. Many owners are surprised to learn their practice is worth significantly more than they thought once its financials are properly presented.

Post-Sale Considerations: Shaping Your Future

The transaction is not just about the final price. It is about what comes next for you, your team, and your legacy. A well-structured deal considers your personal and professional goals from the very beginning. Thinking about these elements upfront gives you more control over your transition.

Your Future Role

Do you want to retire immediately, or would you prefer to continue practicing for a few more years with less administrative burden? Your desired role will influence the type of buyer you partner with and the structure of the deal. Many deals are structured to keep physician owners clinically involved, freeing them from the headaches of management.

Structuring Your Payout

Not all of the proceeds may come as cash at closing. Buyers may propose an “earnout,” where you receive additional payments for hitting future performance targets, or an “equity rollover,” where you retain a minority stake in the new, larger company. This rollover can provide a “second bite at the apple,” offering significant upside when the larger platform is eventually sold.

Protecting Your Legacy

You have spent years building your practice and your team. A good transition plan ensures your staff are treated well and your patients continue to receive excellent care. Finding a buyer whose culture aligns with yours is a critical, non-financial part of the deal. It ensures the practice you built continues to thrive.

Frequently Asked Questions

What is the current market climate for selling a pain management practice in Kansas?

The market climate in Kansas for selling pain management practices is very strong. A significant portion of adults in Kansas live with chronic pain, creating a steady patient base. Additionally, there is high buyer demand driven by an aging population and interest from private equity and strategic buyers, making now a favorable time to sell.

What financial preparations should I make before selling my pain management practice?

You should ensure your financial records are clean, consistent, and show clear trends in revenue and profitability. Buyers analyze patient volume, procedure mix, and facility fee revenue. It’s advised to start this financial cleanup 1-2 years before a potential sale to maximize your practice’s valuation.

How important is operational readiness in the sale of a pain management practice?

Operational readiness is crucial. Practices that are less dependent on the owner and have multiple providers and documented processes are more valuable. Buyers want turnkey operations with scalable systems, as they are purchasing a business rather than a job.

What are the key phases involved in the sale process of my practice in Kansas?

The sale process typically involves four key phases: 1) Preparation & Valuation, 2) Confidential Marketing, 3) Buyer Negotiation, and 4) Due Diligence & Closing. Each phase is designed to protect your confidentiality, create competitive buyer tension, and ensure a smooth transaction.

How can I ensure my practice’s legacy and my role after the sale?

To protect your legacy, find a buyer whose culture aligns with yours to ensure patient care and staff treatment remain excellent. Consider your future involvement, whether you want to retire or continue practicing with less burden. Deal structures can include earnouts or equity rollover for ongoing financial benefits and influence.