Choosing your next practice location is one of the highest-stakes decisions you’ll make as an owner. You’re committing to multi-year leases, significant build-out costs, and a decision that will define your practice’s future. Get it right, and you build a thriving, valuable asset. Get it wrong, and you’re stuck in a struggling location, wondering where all the patients are.

At SovDoc, we analyze practice locations for acquisitions and expansions constantly. The most successful practices we see use a data-driven location strategy. Those that struggle often rely on gut feeling and convenience.

This guide walks you through the core methodology for evaluating a practice location. You don’t need to be a data scientist, but you do need to ask the right questions and know where to find the answers.

Why Does Location Directly Impact Practice Value?

Location isn’t just a backdrop. It is an active driver of your practice’s success and eventual sale price. It dictates patient volume, revenue potential, operating costs, and competitive advantages.

We’ve valued practices where the location was the primary asset. Strong demographics, limited competition, and excellent visibility created a business that practically ran itself. Buyers see this as a sustainable advantage and pay a premium for it.

Conversely, we’ve seen great physicians prop up practices in terrible locations. When those owners decide to sell, buyers hesitate. They know they can’t replicate the personal relationships that compensated for the location’s weaknesses.

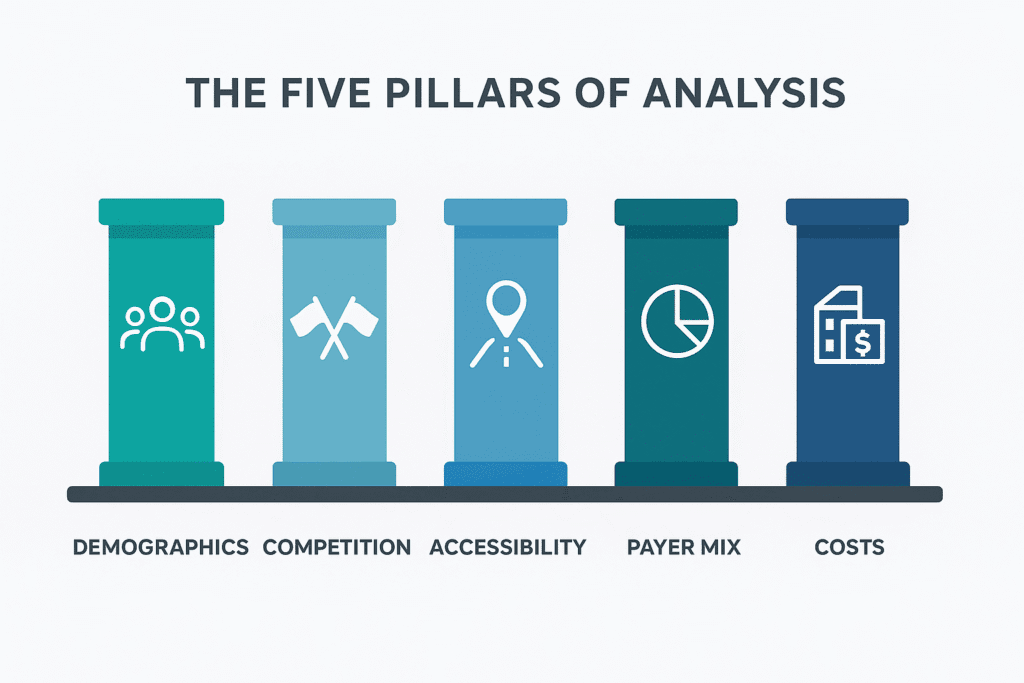

What Data Do I Actually Need for a Location Analysis?

Don’t get lost in the data. A robust analysis rests on five key pillars. Your analysis must tell a complete story, covering the local demographics, existing competition, patient accessibility, the area’s payer mix, and your projected operating costs.

Where Can I Find Reliable Location Data?

You can gather most of the essential data yourself using free or low-cost sources. Before paying for expensive reports, prepare your practice for evaluation by starting with publicly available information. This table breaks down the most valuable resources.

| Data Source | What It Provides | Cost |

| U.S. Census Bureau | Foundational demographic data: population, age, household income, and growth trends by zip code or census tract. | Free |

| State Health Dept. | County or regional health statistics, including disease prevalence and uninsured rates, to understand local health needs. | Free |

| State Medical Board | A complete database of licensed physicians, allowing you to map competitors by specialty and location. | Free |

| Google Maps & Local Search | Real-world context: traffic patterns, nearby businesses, parking situations, and patient-facing visibility. | Free |

| Commercial Real Estate Agents | On-the-ground intel on lease rates, available spaces, and what other medical practices are doing in the area. | Free (Commission-based) |

| Local Chamber of Commerce | Information on major employers, economic projects, and future growth plans before they appear in census data. | Free / Membership |

| Paid Data Vendors (e.g., Esri) | Highly detailed demographic, psychographic, and market analysis. Worth considering for major investment decisions. | Paid |

How Do I Define My Practice’s Service Area?

Forget drawing a simple 5-mile circle on a map. Patients don’t travel in perfect radiuses. They follow roads and seek convenience. Your true service area is defined by drive time.

For most primary care practices, this is a 10-15 minute drive time. For specialists, it can extend to 20-30 minutes or more, depending on the uniqueness of your service. Use a tool like Google Maps to plot drive times from your potential site during peak and off-peak hours. A 10-minute drive at 11:00 AM can easily become 30 minutes at 8:30 AM.

Look for natural and psychological barriers. Highways without easy exits, rivers, or even a reputation for bad traffic can effectively cut off patient populations that are geographically close. If you are expanding, map where your current patients live. This real-world data is the best indicator of true travel patterns.

What Demographics Matter for My Specialty?

Raw population numbers are just a start. Success depends on finding the right population for your specific services.

A pediatrics practice needs young families, so look for a high percentage of children under 18 and adults aged 25-40, along with growing school enrollment. In contrast, a geriatrics practice needs a stable population of seniors, particularly those over 75, and the presence of senior housing developments.

Orthopedics and sports medicine thrive in active communities with youth sports leagues and recreational facilities. Concierge medicine requires high-income households, while a practice focused on a specific condition, like diabetes, should analyze local disease prevalence data from the state health department.

Finally, analyze insurance coverage. A high-Medicare area offers steady volume but lower reimbursement. A high-commercial insurance area promises better revenue but likely more competition.

How Should I Assess the Competition?

Your goal isn’t just to count competitors, but to understand market capacity. Is there room for another provider?

Start by mapping every practice offering similar services within your defined service area. If they are all clustered in one medical park, a location on the other side of your service area could tap an underserved population.

Pro Tip: Call competitors and ask about new patient wait times. A wait of several weeks or months is a clear sign that demand exceeds supply.

Next, investigate their operational capacity and review their online reputation. A sea of mediocre reviews signals an opportunity for a practice that can deliver a better patient experience. Finally, check which insurance networks they are in. This reveals the dominant payers and may expose gaps you can fill.

What Makes a Location Truly Accessible?

The best demographics and limited competition mean nothing if patients can’t easily get to you.

Drive the routes from major residential areas to your site at different times of day. Evaluate the parking situation with brutal honesty. Is it free, ample, and close to the door? “Street parking is available” is often a red flag for patients with mobility issues or small children.

Visibility is free marketing. Can patients easily spot your practice from the main road, or is it hidden in the back of a complex? Clear signage and a visible storefront attract new patients and reduce frustration. Also, consider the benefit of co-location. Being in a medical building with labs, imaging centers, and other specialists creates a convenient, one-stop-shop experience that builds patient loyalty.

How Do Payer Mix and Costs Determine Profitability?

Revenue projections are exciting, but costs determine your actual profit. The location you choose is a primary driver of both.

The insurance profile of your service area dictates your revenue per visit. An area dominated by large employers with strong benefits will yield a robust commercial payer mix and higher collections. An area with an aging population will be Medicare-heavy. Model your expected patient volume against the likely payer mix to project revenue realistically.

On the expense side, analyze real estate rates, typical staff wages for the area, and potential build-out costs. A turnkey space in a medical building may have higher rent but save you hundreds of thousands in construction. Don’t let the pursuit of a “premium” high-revenue location blind you to the crushing costs that can determine your practice’s profitability, often measured by metrics like EBITDA.

Validating Your Final Decision

Before committing to a lease or purchase, your analysis must provide confident answers to several critical questions. A decision based on hope is a strategy for failure. A decision based on data is an investment in your practice’s future value.

First, confirm the fundamental market viability. Your data must prove that the location can generate sufficient patient volume. Does your financial model, supported by local demographics and payer mix, show a clear path to profitability, not just high patient volume? You must also have a clear-eyed view of the competitive landscape. Are you entering an underserved market or a saturated one where you will fight for every patient?

Next, assess the practical reality for your patients. Beyond the data, is the location genuinely convenient and accessible? A difficult commute or poor parking can undermine the most promising location on paper. If getting to your office is a chore, patient retention will suffer.

View the location through the eyes of a future buyer. Will they see a strategic asset with sustainable advantages or a liability tied to a declining area? The answer will define the enterprise value you are building today.

Finally, evaluate the long-term risk and strategic value. Model your worst-case financial scenario to ensure it is survivable. Most importantly, you must view the location through the eyes of a future buyer. Preparing for their due diligence process now will help you understand if you are building an asset that commands a premium valuation.

Putting Your Analysis to Work

Your location analysis is more than a hurdle to clear. It is a strategic document that should guide your business decisions. Use it to negotiate your lease, secure financing, and direct your marketing budget. Revisit it annually to stay ahead of market changes and refine your growth strategies.

Choosing a location is a complex decision, but a structured analysis removes the guesswork and mitigates risk. The practices that invest in this upfront work consistently make better decisions and build more valuable, resilient businesses.

If you are facing a critical location decision and need an expert partner to help translate data into an actionable strategy, Contact SovDoc today. We help practice owners make confident decisions that build long-term value.