In practice management, the patient’s financial experience is often treated as a back-office function, separate from clinical care. However, financial touchpoints—from cost estimates to the final bill—are a crucial part of the overall patient journey.

When patients encounter confusing statements or unexpected bills, it doesn’t just create frustration. It can lead to negative online reviews, patient churn, and a direct, negative impact on your practice’s valuation.

For practice owners focused on growth strategies or positioning for a future acquisition, your billing operations are a significant, yet often overlooked, driver of value. This guide provides the roadmap to optimize this process.

Why Does Patient Financial Experience Impact Your Practice Value So Much?

When buyers and investors evaluate your practice, they scrutinize your revenue cycle metrics before they even look at your clinical quality scores. Why? Because these numbers reveal the operational health and predictability of your revenue. A clunky, inefficient billing process is a major red flag. It signals underlying problems that will cost a new owner time and money to fix.

Your patient financial experience is reflected in every key performance indicator (KPI) that determines your practice’s valuation multiple. High days in accounts receivable (A/R), significant bad debt, and a stream of billing-related complaints all point to reputational risk and operational drag.

Conversely, practices with optimized financial operations command premium valuations. They demonstrate efficiency and a stable, predictable cash flow—qualities that directly increase your final sale price.

| Key Metric | Industry Average | High-Performer Benchmark | Why It Matters in a Sale |

| Patient Payment Collection Rate | ~50% | 65-70% | Proves your ability to convert services into cash. A 20-point gap directly impactsEBITDA. |

| Days in Patient A/R | 40-50 days | < 30 days | Demonstrates a tight, efficient collection process and healthy cash flow for a new owner. |

| Bad Debt Write-Offs | > 2% of net revenue | < 2% of net revenue | Indicates effective upfront financial clearance, reducing risk for the buyer. |

| Billing Satisfaction Score | Often untracked | > 85% | A proxy for patient retention and brand strength. Lowers perceived risk. |

How Can You Enhance the Patient Financial Experience?

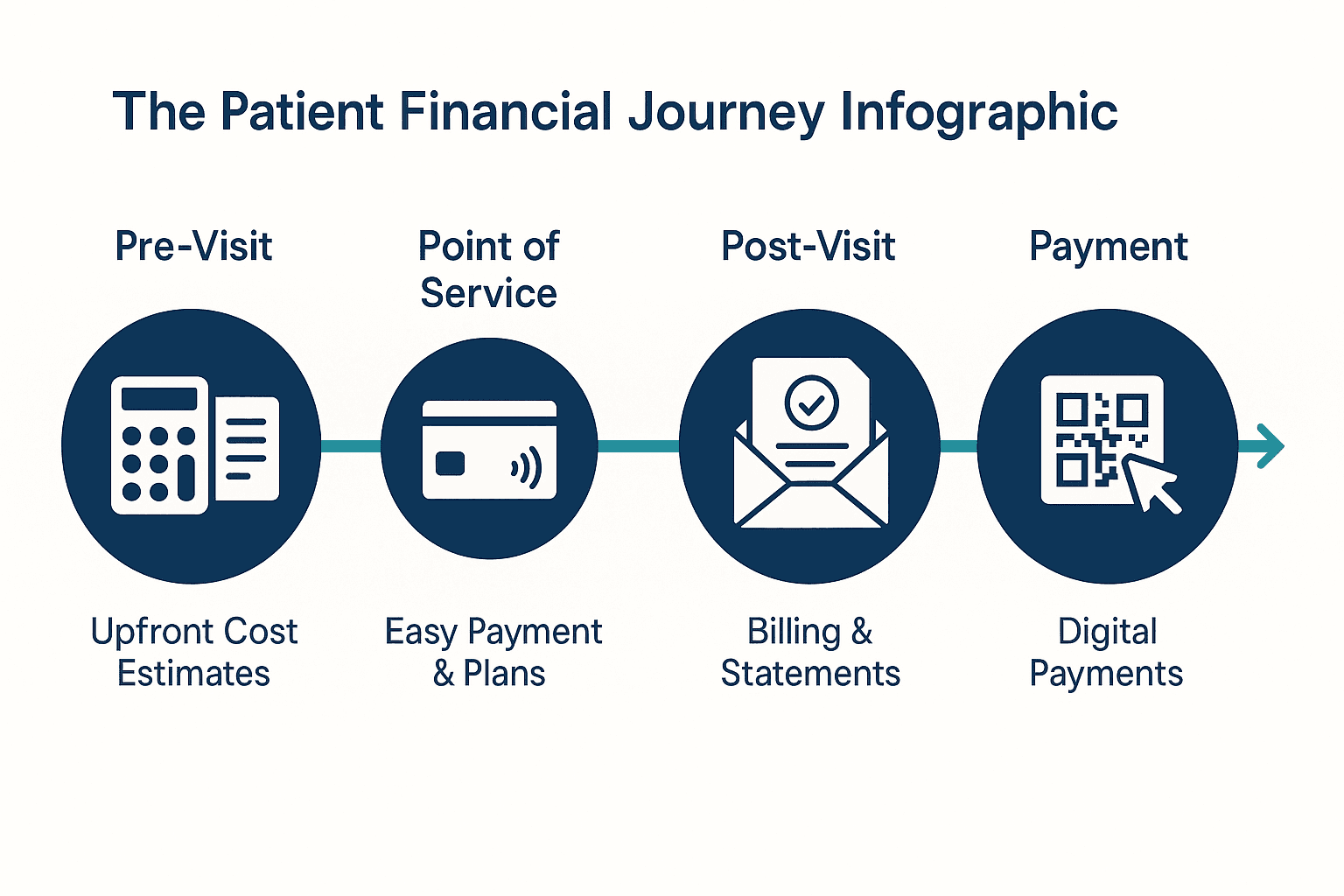

Improving the patient financial journey is a systematic process that relies on clear communication. The best way to prevent downstream problems is to set expectations before and during the visit. This begins with implementing pre-service financial clearance, where your team uses tools to generate accurate cost estimates and has a transparent conversation with the patient about their responsibility.

Practices that provide upfront cost estimates see point-of-service collections increase by 30-40%.

To support this, train and empower a financial counselor to discuss costs and offer options like payment plans. At the point of service, make it easy for patients to pay by accepting cards and digital wallets, and more importantly, by offering flexible, no-interest payment plans that can improve total collections by another 15-20%.

The process continues long after the patient leaves. Your billing statement is a critical touchpoint and must be designed for the patient, not your billing department. A clear, redesigned statement should feature the “amount you owe” prominently, use plain language for services, and be sent promptly within 7-10 days of the visit. A bill sent weeks later often feels like a surprise, leading to confusion and delayed payments. Finally, make it effortless for patients to pay by including simple channels like a QR code for mobile payment or a direct link to your online portal.

What Technology Can Optimize Your Financial Operations?

Modern technology can automate and streamline this entire process, delivering a significant return on investment. This begins with price transparency tools, which integrate with your fee schedules and insurance data to generate reliable cost estimates for pre-service clearance and regulatory compliance.

A strong patient engagement platform can increase patient collections by 40-50% within six months.

These are complemented by digital payment platforms that offer text-to-pay, mobile apps, and point-of-service terminals. Finally, automated communication systems complete the ecosystem by sending personalized billing reminders via text or email, using a helpful tone that keeps patients engaged without harassing them or overwhelming your staff. These systems must also be secure, following established healthcare cybersecurity frameworks.

How Will Optimizing Patient Finances Maximize Your M&A Outcome?

For practice owners considering a sale or partnership in the next 1-3 years, this is not optional—it is a strategic imperative.

During due diligence, buyers will dissect your revenue cycle data. A clean, efficient operation with high collection rates and low bad debt directly increases your EBITDA and, consequently, your practice’s final purchase price. It demonstrates a well-run business with predictable revenue, strong patient retention, and lower compliance risk. This is precisely what buyers from private equity pay a premium for.

Your Next Steps to a Higher Valuation

Improving your patient financial experience is one of the highest-impact practice value enhancement strategies you can undertake. First, assess your current state by calculating your collection rates, days in A/R, and bad debt, and review patient satisfaction scores for comments on billing. Once you have a baseline, prioritize the highest-impact changes, which for most practices are implementing upfront cost estimates, offering flexible payment plans, and redesigning billing statements for clarity. Finally, take action to implement these changes. They can often be rolled out within 90 days and deliver measurable improvements in cash flow and patient satisfaction within six months.

The market for healthcare M&A rewards operational excellence. The time you invest now in fixing your billing operations will pay dividends, both in today’s cash flow and in the ultimate value of the practice you’ve worked so hard to build.

If you’re exploring strategic growth or positioning your practice for M&A, SovDoc specializes in helping practice owners maximize value through comprehensive operational assessments and strategic advisory services. We can help you identify the highest-impact improvements to your patient financial experience and revenue cycle operations. Ready to optimize your practice value? Connect with a SovDoc expert today.