Selling your Rhode Island cardiology practice presents a unique window of opportunity. The market is active, driven by significant interest from private equity firms looking to expand their footprint in the cardiovascular space. This guide provides an overview of the current landscape, from understanding your practice’s true value to navigating the sale process. Making an informed decision starts with understanding your options in today’s dynamic market.

A Look at the Rhode Island Cardiology Market

A Consolidated Landscape

The market for cardiology practices in Rhode Island is not just active; it is a focal point for consolidation. Private equity (PE) firms have shown a strong appetite for cardiovascular care. In fact, Rhode Island is one of only seven states where PE-backed groups own over 10% of all cardiology practices. Local data shows this clearly, with 13 out of the state’s 35 practices already part of larger platforms. This trend indicates a fundamental shift in the ownership landscape, moving from smaller independent practices toward larger, integrated networks.

What This Means for You

For an independent practice owner, this environment presents both opportunity and risk. The high demand from well-capitalized buyers can lead to premium valuations. However, it also means that the competitive landscape is changing. Understanding how to position your practice to attract the right kind of buyer, whether a PE platform or a strategic health system, is now a critical part of a successful exit strategy.

Key Considerations for Practice Owners

Selling your practice is a major financial and personal decision. We find that many physicians, particularly in a close-knit state like Rhode Island, are concerned about more than just the final sale price. You have likely spent decades building not just a business, but a reputation and a team that feels like family.

A common concern we hear is about life after the sale. Will you lose clinical autonomy? What will happen to your dedicated staff? These questions are valid. The buyer you choose has a direct impact on these outcomes. A transaction with a private equity group is very different from one with a local hospital system. The right partner will respect your legacy, while the wrong one can undermine it. Aligning your personal and professional goals with the right buyer is the first step toward a transition you can feel good about.

Current Market Activity and Trends

The level of interest in Rhode Island cardiology practices is not theoretical. It is manifesting in real transactions at an accelerating pace. If you are considering a sale, it is helpful to know the forces at play.

Here are three market forces currently driving sales:

- Platform Expansion: Large private equity-backed cardiology platforms have already been established. Their growth model depends on acquiring smaller, high-quality local practices like yours to expand their geographic reach and patient base.

- Strategic Add-Ons: Your practice is more than a standalone business. To a larger group, it is a strategic “add-on” that can create immediate value by plugging into their existing infrastructure for billing, marketing, and compliance.

- Search for Efficiency: As healthcare reimbursement models evolve, buyers are looking for well-run practices that can operate efficiently at scale. Independent Rhode Island practices with a strong operational foundation are in high demand.

What Does the Sale Process Involve?

Many practice owners we speak with have never sold a business before. The process can seem opaque. In simple terms, it moves from preparation to closing. You begin by organizing your financial and operational documents, followed by confidential marketing to a curated list of potential buyers.

Once interest is expressed, the process moves to negotiating initial offers and signing a letter of intent. This leads to the most critical phase: due diligence. This is where the buyer conducts an in-depth review of your practice, from financial statements to employee contracts and compliance records. Many promising deals falter at this stage due to a lack of preparation. A well-managed, confidential process not only protects your business but also creates a competitive environment that ensures you receive the best possible terms, not just the first offer that comes along.

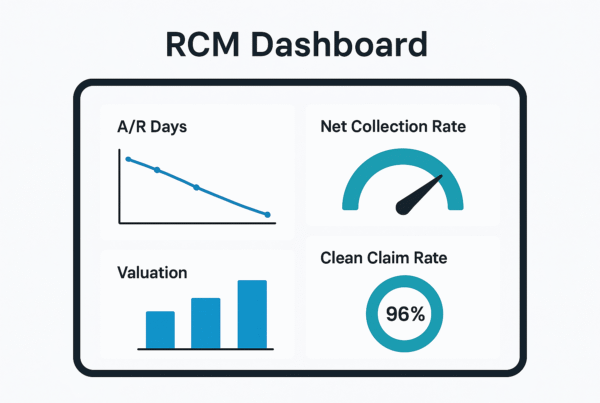

How Is a Cardiology Practice Valued?

One of the first questions any owner asks is, “What is my practice worth?” The answer is more complex than a simple revenue multiple. Sophisticated buyers value your practice based on its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your true profitability after normalizing for owner-specific expenses.

An accurate valuation is the foundation of a successful sale. It is determined by applying a multiple to your Adjusted EBITDA. This multiple is not a fixed number. It changes based on several factors, showing that not all practices are valued equally.

| Valuation Factor | Impact on Your Multiple |

|---|---|

| Practice Scale & EBITDA | Larger, more profitable practices command higher multiples. |

| Provider Model | Less reliance on a single owner increases value. |

| Growth & Ancillaries | A clear growth story or diverse services attract premium offers. |

| Payer Mix | A stable mix of commercial payers is seen as less risky. |

Getting a professional valuation helps you understand what your practice is worth to a strategic buyer, not just what it says on a tax return.

Planning for Life After the Sale

A successful transaction is not just about the day the deal closes. It is also about setting you up for the future you want. For many physicians, this does not mean immediately retiring. Your goals should shape the structure of the deal.

For instance, if you wish to benefit from the future growth of the new, larger company, you might “roll over” a portion of your sale proceeds into equity in the new entity. This gives you a “second bite at the apple” when that larger platform is eventually sold. If a buyer wants to ensure a smooth transition, an “earnout” structure could provide you with additional payments for hitting performance targets post-sale. These structures allow you to remain involved and economically aligned with the practice’s success. Thinking about these possibilities early in the process is key to building a deal that works for you long term.

Frequently Asked Questions

What is the current market environment for selling a cardiology practice in Rhode Island?

The Rhode Island cardiology market is highly active with significant interest from private equity firms. Rhode Island is one of only seven states where PE-backed groups own over 10% of cardiology practices, with 13 out of 35 practices part of larger platforms, indicating a trend toward consolidation.

How is the value of a cardiology practice in Rhode Island determined?

A practice’s value is primarily based on its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Factors influencing valuation multiples include practice scale and profitability, provider model, growth potential and ancillary services, and payer mix. A professional valuation helps understand the true worth to strategic buyers.

What are the major considerations for a cardiology practice owner before selling?

Owners often worry about life after the sale, including loss of clinical autonomy and the fate of their staff. Choosing the right buyer is crucial to protect your legacy and align with your personal and professional goals. The type of buyer, whether private equity or local hospital system, significantly impacts post-sale outcomes.

What does the typical sale process for a cardiology practice involve?

The process starts with preparation, organizing financial and operational documents, followed by confidential marketing to potential buyers. Then, negotiating offers and signing a letter of intent precede an in-depth due diligence phase, where financial statements, contracts, and compliance are reviewed. Proper preparation is essential to ensure favorable terms and a successful sale.

What options exist for a cardiology practice owner regarding involvement after sale?

Owners can structure deals to remain involved and benefit from future growth. Options include “rolling over” a portion of proceeds into equity in the new company or earnout agreements that provide additional payments based on performance targets post-sale. Early planning of these options is key to creating a deal that supports long-term goals.