Selling your Houston-based Neurology practice is a major milestone in your career. This decision involves more than just finding a buyer. It requires understanding your practice’s true market value, navigating a complex sale process, and timing your exit to get the best outcome. This guide offers clear insights into the Houston market to help you prepare for a successful transition and protect the legacy you have built.

Market Overview

The Houston market for specialty medical practices is strong. As a neurologist, your practice is an attractive asset due to the city’s continuous growth and an aging population requiring specialized care. Buyer interest is high, coming from different groups. My experience shows that understanding the landscape is the first step.

Three key factors define the market right now:

- Diverse Buyer Pool: You will see interest from large hospital systems looking to expand their neurology service lines, as well as private equity groups aiming to build regional platforms. Each has a different approach to a deal.

- Favorable Valuations: Neurologists are specialists. These practices often command higher valuation multiples than primary care, typically ranging from 0.8 to over 1.0 times yearly revenue.

- Strategic Location: Houston’s standing as a world-class medical hub adds to your practice’s appeal, providing a stable foundation for a new owner’s future growth.

Key Considerations

Before you dive into the details, it is helpful to step back and look at the big picture. Timing is everything. The best time to sell is when your practice is performing well, not when you are burned out and revenue is declining. Buyers pay for proven success, not just potential. Thinking about this 2-3 years ahead of your target date is ideal.

You also need a plan for your staff and patients. A sudden announcement can create uncertainty. A well-managed transition protects your team and ensures continuity of care for your patients, which also preserves the practice’s goodwill value.

Finally, Texas has specific laws governing practice sales, patient records, and ownership structures. Navigating these rules requires careful attention to detail to avoid compliance pitfalls that could derail a deal.

Market Activity

While specific sale details are confidential, we see a clear trend in the Houston area. Private equity firms and strategic health systems are actively seeking established neurology practices to add to their networks. This competitive tension is driving favorable outcomes for sellers who are well-prepared. The deal structure is often just as important as the price, with options for you to roll over equity or stay on post-sale. A practice’s value is typically viewed as a multiple of its Adjusted EBITDA.

Here is a general look at current market multiples.

| Practice Annual EBITDA | Typical Valuation Multiple |

|---|---|

| Under $500,000 | 3.0x 6 5.0x |

| $1,000,000+ | 5.5x 6 7.5x |

| $3,000,000+ (Platform) | 8.0x 6 10.0x+ |

Sale Process

A successful practice sale follows a clear, structured path. It is not about waiting for a single offer. It is about creating a competitive environment. I always tell my clients that we don’t ‘list’ a practice. We run a professional process to find the best partner.

First, we start with preparation. This involves a deep financial review and a comprehensive valuation to set a realistic price. Next, we move to confidential marketing. We identify and discreetly approach a curated list of qualified buyers while protecting your identity and practice details.

Once we receive interest, we enter the due diligence phase. This is where the buyer inspects your financials, operations, and legal standing. This stage is where many deals encounter problems if preparation was poor. Finally, with all issues resolved, we work with attorneys to finalize the legal agreements and move to a successful closing.

Valuation

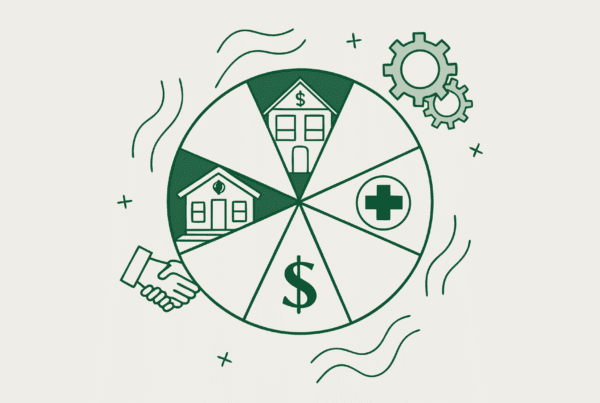

Your practice’s value is more than just a multiple of your revenue. Sophisticated buyers today look deeper, focusing on profitability and future growth potential.

What Buyers Look For

The key metric is Adjusted EBITDA. This stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. More importantly, it “adjusts” your net income by adding back personal expenses run through the business or an above-market owner salary. It reflects the true cash flow available to a new owner. Many physicians are surprised by their practice’s adjusted profitability once we complete this analysis.

Beyond the Formula

The valuation multiple applied to your Adjusted EBITDA depends on your specific risk profile. A practice that relies entirely on you, the owner, will have a lower multiple than one with several associate neurologists. Other factors, like a strong referral network, a favorable payer mix, and documented growth, will command a premium valuation.

Post-Sale Considerations

The journey does not end when the sale agreement is signed. Planning for what comes next is a critical part of a successful exit. Your role after the sale is a key point of negotiation. You may want to leave immediately, or you might agree to stay on for a year or two to ensure a smooth transition. This is a personal decision that impacts the deal structure.

You also need to understand the financial implications. The way your sale is structured, as either an asset or entity sale, has a major impact on your final after-tax proceeds. Planning this in advance can save you a significant amount.

Finally, you will almost certainly be asked to sign a non-compete agreement. The terms of this agreement, including its duration and geographic scope, are negotiable. Getting these post-sale details right ensures your transition out of ownership is as successful as your time building the practice.

Frequently Asked Questions

What factors influence the valuation of a Neurology practice in Houston?

Valuation is primarily based on Adjusted EBITDA, reflecting true cash flow, and the multiple applied depends on risk factors like owner dependency, presence of associate neurologists, referral networks, payer mix, and documented growth. Multiples typically range from 0.8 to over 1.0 times yearly revenue, with EBITDA-based multiples varying by practice size.

Who are the typical buyers interested in Neurology practices in Houston?

Buyers typically include large hospital systems looking to expand their neurology services and private equity groups aiming to build regional platforms. Each has different deal approaches, so understanding the buyer pool helps tailor the sale strategy.

When is the best time to sell a Neurology practice?

The best time to sell is when the practice is performing well, ideally planning 2-3 years ahead of the target sale date. Selling during peak performance, rather than during revenue decline or burnout, secures higher valuations and buyer interest.

What are the key legal considerations when selling a Neurology practice in Texas?

Texas has specific laws regarding practice sales, patient records, and ownership structures. Careful attention is required to navigate compliance and avoid pitfalls that could jeopardize the deal. Consulting with attorneys familiar with these regulations is essential.

What happens after the sale of a Neurology practice?

Post-sale involves negotiating your role and transition period, which could involve staying on to ensure a smooth handover. Financial implications depend on structuring the sale as an asset or entity sale, affecting after-tax proceeds. You will likely sign a non-compete agreement, with negotiable terms regarding duration and geographic scope.