As a practice owner, you operate in a challenging reimbursement environment where costs rise and rates lag. However, many owners overlook one of their most powerful assets: their payer contracts. The difference between a passively managed and an optimized contract portfolio is not just operational—it directly impacts your bottom line and what your practice is worth to buyers and investors. For owners focused on growth strategies or positioning for a future acquisition, your payer contracts are a significant, yet often overlooked, driver of value. This guide provides the roadmap to optimize them.

Why Do Payer Contracts Impact Your Practice Value So Much?

When buyers and investors evaluate your practice, they scrutinize your revenue cycle metrics and payer agreements during the due diligence process. Why? Because these documents reveal the operational health and predictability of your revenue. A portfolio of weak, expiring, or poorly managed contracts is a major red flag.

The Financial Impact: A typical practice might be leaving $125,000 to $175,000 on the table every year due to below-market rates and unmanaged contracts.

Your payer contract strength is reflected in every key performance indicator (KPI) that determines your practice’s valuation multiple. High days in A/R, unfavorable rates, and restrictive terms all point to operational drag. Conversely, practices with optimized payer contracts command premium valuations because they demonstrate efficiency and a stable cash flow—qualities that directly increase your final sale price.

How Do You Analyze Your Current Payer Contracts?

Most practice owners are too busy to conduct a thorough contract analysis. But without it, you are negotiating blind.

Start by gathering all signed contracts, amendments, and fee schedules. Create a spreadsheet to track the contract start date, renewal date, and termination notice period for each payer. For a potential buyer, missing documentation and key dates is a sign of disorganization.

Next, analyze your reimbursement. Pull a report from your practice management system showing your top 20-30 procedures by volume and calculate what each payer actually pays. Compare these rates against Medicare and regional benchmarks. You will likely find large disparities—for example, one payer reimbursing at 110% of Medicare while another pays 145%. That gap is money lost on every patient and a clear area for EBITDA normalization during a sale.

Finally, look beyond rates to operational performance. Track each payer’s average days to payment and initial claim denial rate. A payer with decent rates but high denial rates may be less profitable than one with slightly lower rates but clean, fast processing.

What Defines a Strong Payer Contracting Strategy?

Your negotiating leverage comes from specific, quantifiable factors. Your market position matters most, but your position is also strengthened by geographic exclusivity, scarce specialty services, and strong patient satisfaction scores. Benchmarking your practice’s finances provides the foundation for your negotiation. Use the Medicare Physician Fee Schedule as a baseline and supplement it with data from commercial services like MGMA to set realistic targets.

Pro Tip: The best time to start negotiations is 9-12 months before your contract expires. This gives you maximum leverage and prevents being rushed into a bad deal.

Timing is just as critical as data. Starting early signals that you are organized and serious, providing ample time for discussion without deadline pressure.

How Can You Prepare for a Successful Negotiation?

Payers negotiate contracts every day. You can level the playing field with thorough preparation. Build a data package that tells your value story and frame everything in terms of value to the payer, such as network adequacy, member satisfaction, and total cost of care.

For example, a cardiology practice could present its value proposition to a payer like this:

| Value Proposition | Supporting Data Point | Payer Benefit |

| Patient Volume | 1,250 annual visits from their members. | Significant network presence. |

| Member Satisfaction | 4.8 out of 5.0 patient satisfaction rating. | High member retention. |

| Network Adequacy | Same-day appointment availability. | Meets regulatory requirements. |

| Cost Control | Readmission rates 20% below average. | Lowers total cost of care. |

| Unique Capability | Only practice in 15 miles with nuclear stress testing. | Fills a network gap. |

This data-driven approach is far more powerful than simply asking for “higher rates.” You should also develop specific requests and know your walk-away point to avoid accepting a bad deal under pressure.

How Do Payer Contracts Affect Your Practice’s M&A Value?

During a practice sale, payer contracts receive intense scrutiny. As we detail in our guide on how payor mix impacts valuation, buyers analyze if rates are competitive, how much term remains, and if there are restrictive clauses.

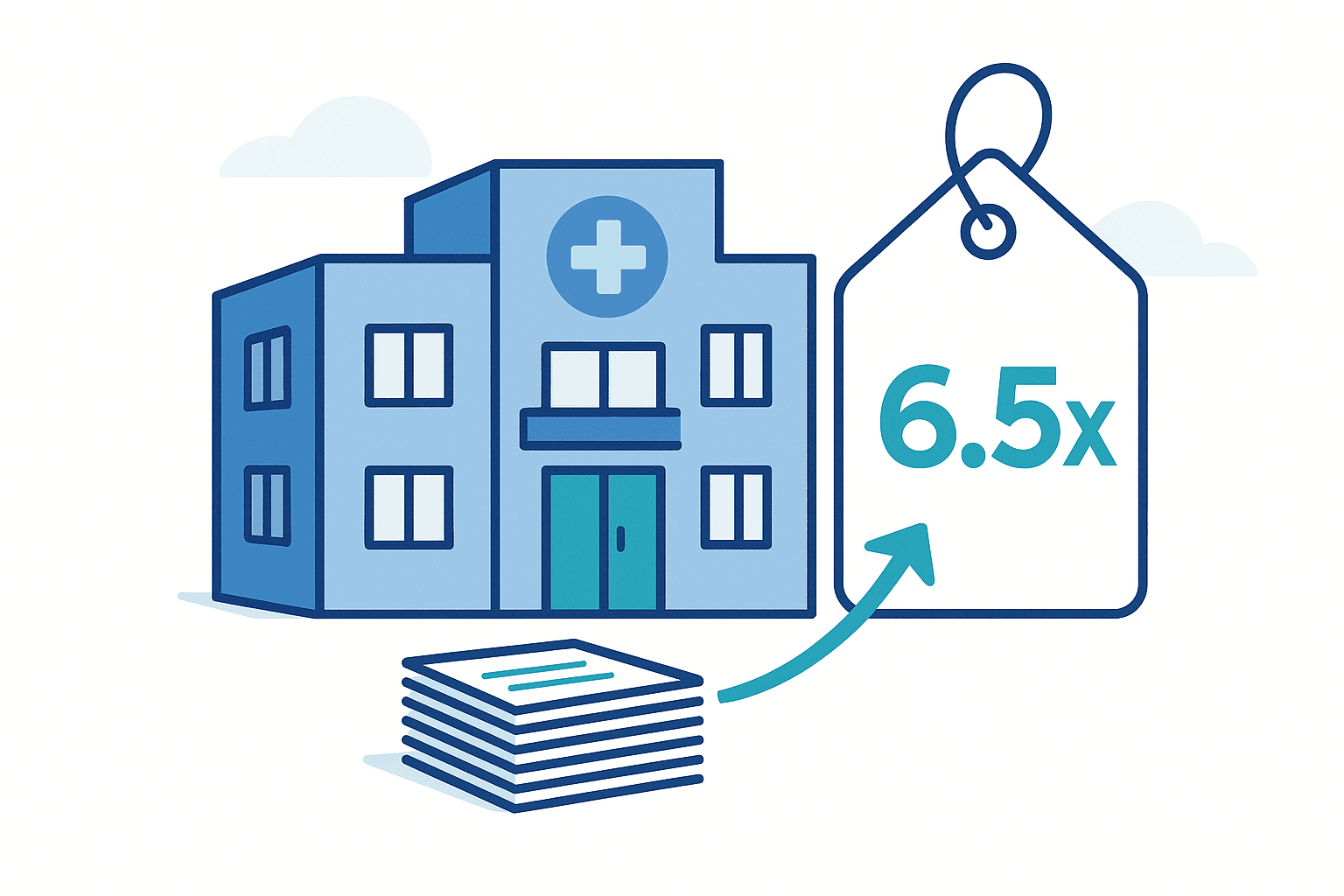

Strong contracts signal sustainable revenue. Weak contracts trigger valuation discounts. For example, we recently advised two similar practices generating $3 million in revenue:

- Practice A had rates at 145% of Medicare with long-term contracts and sold for 6.5x EBITDA.

- Practice B had rates at 120% of Medicare with expiring contracts and sold for 4.8x EBITDA.

The M&A Difference: Strong payer contracts were the primary reason one practice sold for $400,000 more than a similar-sized peer.

This difference in the EBITDA multiple was attributed largely to payer contract quality. If you are considering selling, these practice value enhancement strategies are critical.

Your 18-Month Payer Contract Optimization Roadmap

Transforming your payer portfolio is a systematic effort. This roadmap provides a practical timeline for practice owners.

| Timeline | Key Actions | Expected Outcome / Investment |

| Months 1-3 | Assessment & Preparation: Compile all payer contracts & create an inventory.Analyze reimbursement rates for top 20 procedures.• Benchmark rates against Medicare and market data. | Clear understanding of portfolio strengths and weaknesses.Investment: Primarily internal time, or $5k-$15k for a consultant. |

| Months 4-6 | Priority Negotiations: Develop data packages for 2-3 highest-value contracts.Submit formal rate increase requests.Initiate negotiations on all terms, not just rates. | Improved terms on 1-2 priority contracts.Outcome: $50k-$150k in additional annual revenue.Investment: $2k-$5k for legal review. |

| Months 7-12 | Systematic Portfolio Improvement: Negotiate remaining contracts approaching renewal.Implement quarterly contract compliance audits.Consider terminating 1-2 consistently problematic payers. | Portfolio-wide performance lift and documented improvements.Outcome: Enhanced profitability and operational efficiency. |

| Months 13-18 | Continuous Improvement & Strategic Positioning: Review payer mix and adjust marketing strategies.Lock in long-term agreements (3-5 years).Prepare an updated valuation based on improved financials. | A strategically optimized and highly valuable contract portfolio.Outcome: Maximized cash flow and a practice ready for a premium M&A exit. |

Take Control of Your Practice’s Financial Future

Your payer contracts are strategic assets that dictate your practice’s financial health and long-term value. Shifting from passive acceptance to proactive management is one of the most impactful business decisions you can make. The process requires diligence, but the rewards—increased annual revenue and a significant boost to your M&A valuation—are well worth the effort.

Whether you are focused on expansion or preparing to sell your medical practice, the strength of your payer contracts will be a critical factor. At SovDoc, we specialize in healthcare M&A advisory to help owners maximize their valuation for a successful transaction.

If you’re ready to see how your payer contracts impact your practice’s M&A potential, contact the experts at SovDoc for a confidential consultation