For any medical practice, the clean claims rate—the percentage of insurance claims paid on the first submission without errors—is a critical indicator of financial health. A low rate can significantly impact cash flow. For example, a practice generating $2 million annually with an 80% clean claims rate leaves approximately $400,000 each year in delayed or denied revenue. Whether you’re considering selling your practice or simply want to maximize your revenue, clean claims rate optimization should be a top priority.

What Should Your Clean Claims Rate Target Be?

Formula Clean Claims Rate = (Number of Claims Paid on First Submission ÷ Total Claims Submitted) × 100

Industry benchmarks set the gold standard at a 95-98% clean claims rate. If you’re hitting this target, you’re operating at an elite level. Most practices fall short of the benchmark, creating a gap that represents millions of dollars in lost revenue across the healthcare industry due to rework, delays, and write-offs. Understanding how to maximize the valuation of your healthcare practice includes optimizing these critical operational metrics, while practice value enhancement strategies demonstrate how clean claims rates directly impact overall practice worth.

| Performance Level | Clean Claims Rate | Status | Action Required |

| Excellent | 95-98% | Elite performance | Maintain current practices |

| Good | 90-95% | Above average | Minor improvements needed |

| Average | 85-90% | Industry standard | Significant opportunity exists |

| Below Average | 80-85% | Concerning | Immediate attention required |

| Unacceptable | Below 80% | Critical | Major overhaul needed |

Reality Check: The best practice clean claim rate is 95-98%, but most hospitals average only 75% while physician practices achieve around 85%. This performance gap costs the industry millions in lost revenue annually.

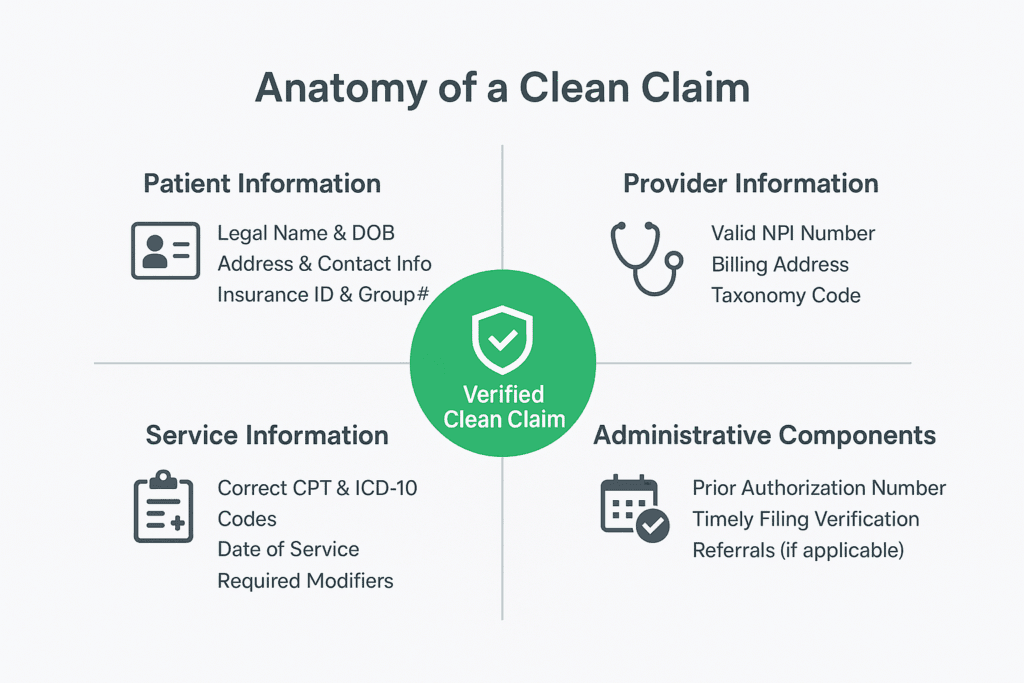

What Makes a Clean Claim?

Understanding why claims get denied helps you focus your claims process improvement efforts. The top denial reasons include:

- Missing or inaccurate patient data

- Authorization issues

- Incomplete patient information

- Insufficient documentation

- Patient eligibility errors

- Untimely filing

A clean claim must include complete and accurate information across four key areas. Patient information requires the legal name, date of birth, address, and insurance ID—common errors include typos, outdated coverage, and wrong spelling. Provider information needs valid NPI numbers, billing addresses, and taxonomy codes, with frequent mistakes being expired credentials and wrong specialty codes. Service information must contain correct CPT codes, ICD-10 codes, and dates of service, while avoiding unsupported diagnoses and missing modifiers. Administrative components include prior authorization numbers and timely filing, where missing authorizations and late submissions cause most problems.Understanding clean claim rates and implementing effective revenue cycle optimization strategies are essential for maintaining operational efficiency.

Critical Statistic: Nearly half of all claim denials stem from missing or inaccurate patient data—making front-end data collection your highest-impact improvement opportunity.

How Can You Prevent Claims Errors Before They Happen?

The most cost-effective strategy is preventing errors before claims are submitted. However, we often find that practices focus on fixing denials instead of preventing them, which is like constantly patching a leaky roof instead of replacing it. With the right strategies, that can be changed resulting in better healthcare practice management.

- Verify Insurance Eligibility in Real-Time: Check patient eligibility at least 48-72 hours before appointments and again on the day of service. Coverage can change rapidly, especially with Medicare Advantage plans. This single step can prevent 30-40% of denials.

- Standardize Patient Intake: Create uniform intake forms across all locations and departments. Train your staff to transcribe information exactly as it appears on insurance cards (even spacing and punctuation matter to automated systems). Practices can reduce data entry errors by 60% simply by implementing consistent intake procedures.

- Implement Prior Authorization Tracking: Develop a system to track which services require authorization for each payer. Obtaining authorization before service delivery is infinitely easier than appealing denials after the fact. Consider creating a master list of services that commonly require prior authorization for your top five payers.

ROI Alert: Real-time eligibility verification alone can prevent 30-40% of denials. For a practice processing $100,000 monthly in claims, this translates to $6,000-$8,000 in prevented denials each month.

What Technology Solutions Can Improve Your Claims Process?

Modern claims management technology acts as your quality control inspector, catching errors before they leave your office. Optimizing clean claim rates requires leveraging the right technology stack to support your claims process. You can use claims scrubbing software to perform hundreds of validation checks in seconds, integrated clearinghouse services to provide real-time validation and status tracking, and AI-Powered Solutions to predict which claims face high denial risk before submission, allowing preemptive correction. While the initial investment may seem significant, the ROI typically ranges from 3:1 to 5:1 within the first 18 months.

| Solution Type | Benefits | Typical ROI | Implementation Time |

| Claims Scrubbing | Catches errors pre-submission | 4:1 within 12 months | 2-4 weeks |

| Integrated Clearinghouse | Streamlines submission | 2:1 within 6 months | 2-6 weeks |

| AI Denial Prevention | Predicts high-risk claims | 5:1 within 18 months | 6-12 weeks |

Technology Tip: AI-powered solutions represent the cutting edge of clean claims rate optimization, with some organizations achieving 98-99% success rates. The 5:1 ROI makes this technology investment highly compelling for practices processing significant claim volumes.

How Should You Optimize Your Claims Workflow?

Streamlined processes eliminate bottlenecks and minimize errors through standardization, ultimately reducing denial rates. You should aim to submit claims within 24-48 hours of service delivery. It is important to establish clear timelines because faster submission enables faster payment and easier problem resolution while documentation remains fresh in everyone’s memory.

Claims submission should happen within 24-48 hours of service, eligibility verification should occur 48-72 hours before appointments, prior authorization should be obtained at the time of scheduling (5-10 business days ahead), denial review should happen within 24 hours of receipt, and appeal submission should occur within 15 days of denial.

To make the claim process smoother, you can batch similar claim types together for more efficient processing and reduced manual workload. For example, process all routine office visits together, then handle procedures separately. You can also create denial management protocols to track denial patterns monthly and address root causes systematically.

Timing Matters: Claims submitted within 24-48 hours get paid faster and face fewer complications. Delayed submissions often encounter documentation issues and increased denial rates.

Why Is Staff Training Critical for Clean Claims?

Your team is your most valuable asset in clean claims rate optimization. Even the best technology can’t overcome human error in data entry or coding. Certified coders from AAPC or AHIMA understand the 69,000+ diagnosis codes, 10,000+ procedure codes, and complex payer guidelines that change annually. We recommend investing in ongoing education (e.g. monthly training sessions) because code sets change every January, and payer policies evolve throughout the year.

Training ROI: Certified coders deliver measurable value. Practices with certified staff typically see 15-25% higher clean claims rates compared to those with non-certified coders.

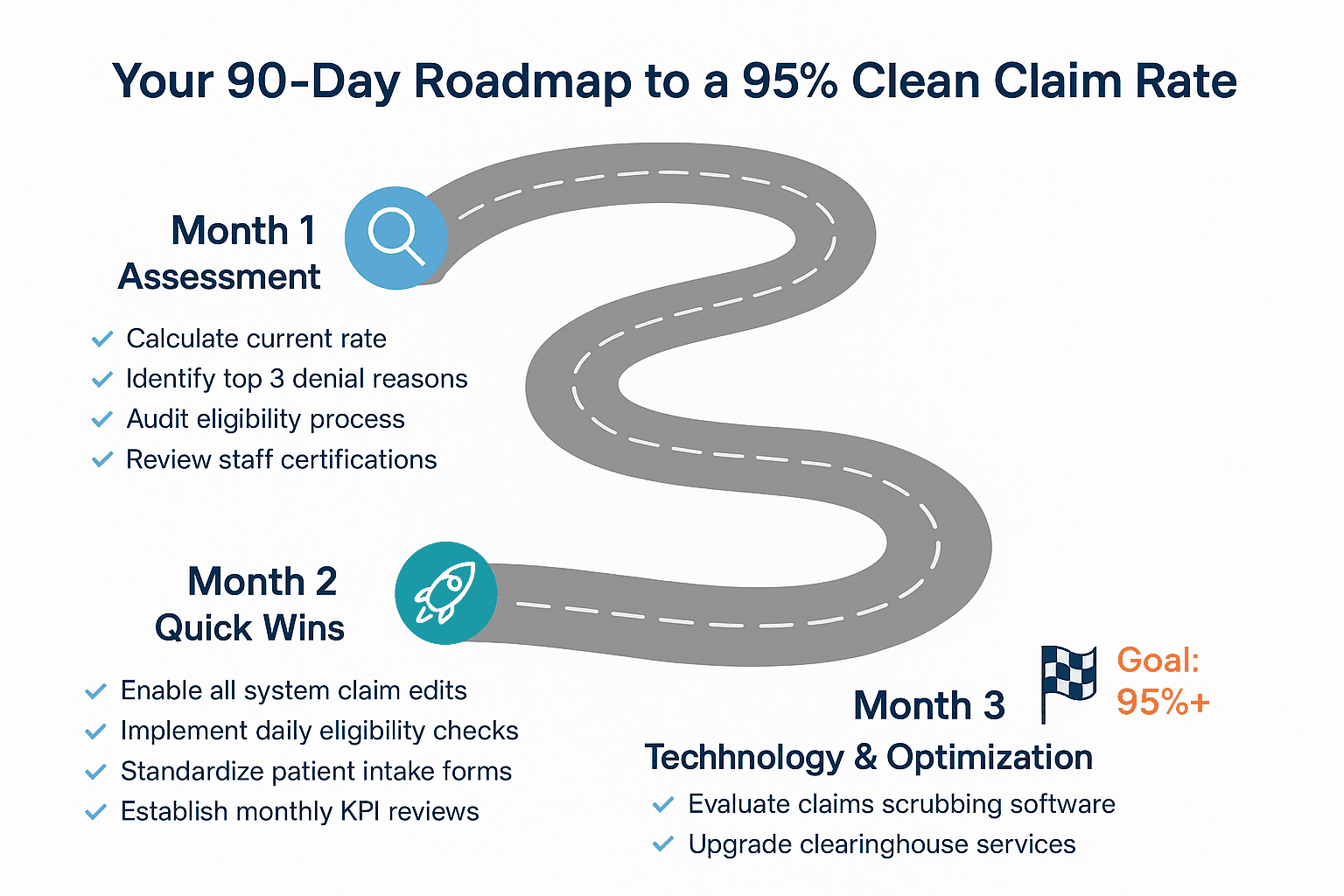

What’s Your Action Plan?

Here’s an immediate roadmap to follow for your revenue cycle optimization, based on our experience helping medical practices improve their clean claims rate.

Expected Results: Following this roadmap, most practices see a combined improvement of 20-35% in their clean claims rate, translating to significant cash flow improvements within the first quarter.

Why A Clean Claims Rate Is Crucial To Your Practice

Achieving a 95% clean claims rate goes beyond mere operational efficiency, it ensures you build a more valuable practice. When potential buyers evaluate medical practices, clean revenue cycle operations directly impact valuation. Practices demonstrating consistent 95%+ clean claims rates command premium prices because strong claims rates demonstrate operational excellence and buyers know they’re acquiring predictable cash flow. For practices considering growth strategies or preparing for a future exit, clean claims rate optimization serves as a foundation that supports both objectives. Additionally, practices with optimized claims processes often benefit from improved payer contract optimization, as efficient operations provide leverage in contract negotiations.

Bottom Line: Clean claims rate optimization delivers both immediate cash flow benefits and long-term strategic value. Practices with optimized claims processes see improvements in cash flow within 60-90 days and build more valuable, sellable businesses over time.

By implementing these changes systematically, you can improve your immediate cash flow while building a more valuable and financially stable practice for the future. The improvements typically start showing up in your cash flow within 60-90 days, making this one of the fastest ways to enhance your practice’s financial performance through effective claims process optimization.

Ready to Optimize Your Practice’s Financial Performance?

Clean claims rate optimization is just one component of building a high-value, operationally excellent practice. Whether you’re looking to improve cash flow, prepare for growth, or position your practice for a future sale, the right strategic guidance can make all the difference. At SovDoc, we specialize in helping healthcare practice owners maximize their operational efficiency and practice value. Our team of experts understands the complexities of revenue cycle management, operational optimization, and practice valuation.

Contact SovDoc today to discover how we can help you transform your practice’s financial performance and build long-term value.