The market for buying and selling pediatric practices has changed significantly. Historically, a practice sale was often an internal transition to a junior partner for 1-2 times earnings. Today, private equity (PE) firms and other large buyers are actively acquiring pediatric practices, with valuations reaching 5-7x EBITDA or higher.

This shift creates a major opportunity for owners. Multiple well-funded buyers are now competing for quality practices, driving up valuations. This guide outlines what these buyers look for and the steps you can take to position your practice to command a premium price.

How Buyers Determine Your Practice’s Value

When evaluating your practice, buyers focus on key indicators of financial health and operational efficiency. While many factors are considered, your valuation ultimately starts with one primary metric: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This is the key measure of your core profitability. An attractive practice should aim for a healthy bottom line, as every percentage point of margin improvement directly increases your final sale price.

The Target: An attractive practice should aim for an EBITDA margin of 20-25%. On a practice with $2 million in revenue, improving your margin from 20% to 25% through proper EBITDA normalization could add $600,000 to your valuation at a 6x multiple.

Practice Size Determines Your Multiple

The size of your practice directly influences the valuation multiple a buyer will offer. Larger practices are perceived as lower risk and better platforms for growth. As shown in the table below, growth doesn’t just add to your profits; it increases the multiple applied to those profits, leading to a non-linear increase in value.

| Practice Size (by EBITDA) | Typical EBITDA Multiple |

| Small (<$1M) | 3.0x – 6.0x |

| Mid-Sized ($1M – $5M) | 6.0x – 10.0x |

| Large Platform (>$5M) | 8.0x – 13.0x+ |

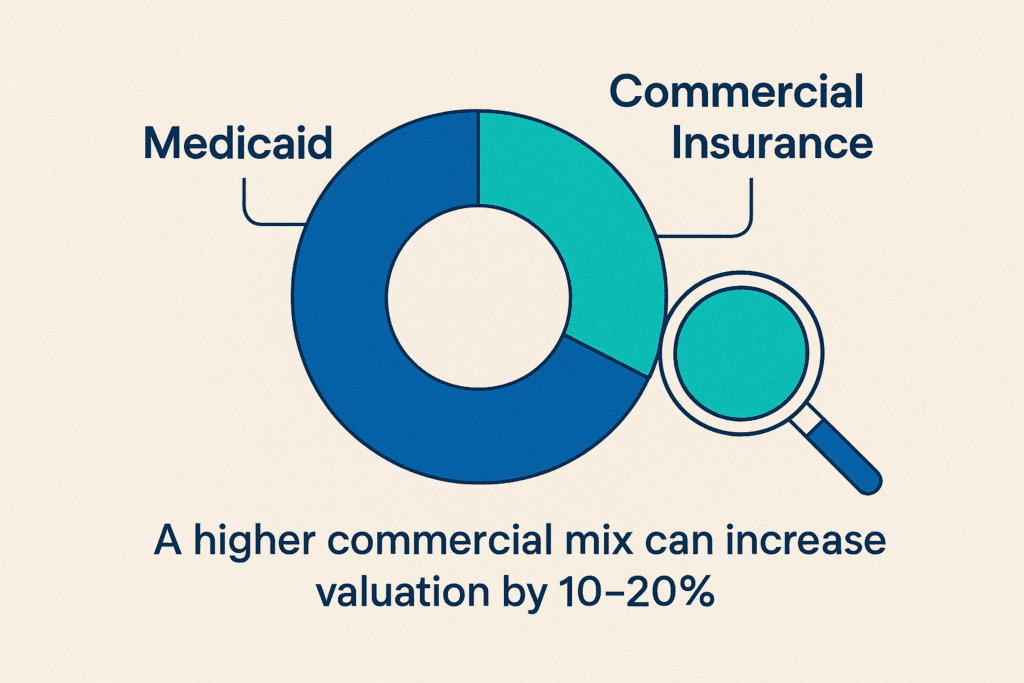

Payer Mix and Billing Efficiency Matter

Buyers carefully analyze your revenue sources and collection processes. A practice with a higher percentage of commercial insurance revenue may be valued 10-20% more than a practice heavily dependent on Medicaid. The impact of your payer mix on valuation cannot be overstated.

Beyond payer mix, your operational efficiency in billing is also critical. An efficient practice demonstrates strong cash flow by keeping its Days in Accounts Receivable (AR) under 30 and achieving a net collection rate above 95%. Falling short of these benchmarks signals operational problems that will lower your valuation, as a buyer will factor in the cost of fixing them.

How to Build a More Valuable Practice

Buyers pay a premium for businesses that are stable, scalable, and not dependent on a single individual.

To achieve this, first consider diversifying your income beyond standard visits. Adding ancillary services like in-office labs, lactation consulting, or integrated behavioral health creates new, high-margin revenue streams. Second, build a scalable team. A practice built around one “star” doctor is a major risk for a buyer. Develop a team with multiple physicians and a strategic mix of NPs and PAs to show the practice can succeed without you.

Finally, you must modernize your technology. An outdated or non-pediatric EHR is a financial liability that a buyer will use to negotiate a lower price. Having the right IT and EHR specialists for your primary care practice is critical to avoiding post-transaction integration challenges.

A Costly Mistake: An outdated, non-pediatric EHR can be a major red flag. A buyer will calculate the replacement cost—often $50,000 to $200,000—and may deduct it directly from their offer.

Demonstrating your commitment to quality is another powerful way to increase value. Earning Patient-Centered Medical Home (PCMH) recognition signals that your practice is prepared for value-based care models, which can lead to better payer reimbursements and a higher valuation.

Common Issues That Lower Valuations

Before entering the market, it is crucial to address any potential red flags, as buyers will uncover them during financial due diligence. The most significant issues include inaccurate or incomplete financial records, which destroy a buyer’s trust. A trend of declining revenue or patient volume signals fundamental business challenges. Operationally, high staff turnover points to management or cultural problems, while significant compliance gaps related to billing or referrals can create liability risks that deter serious buyers.

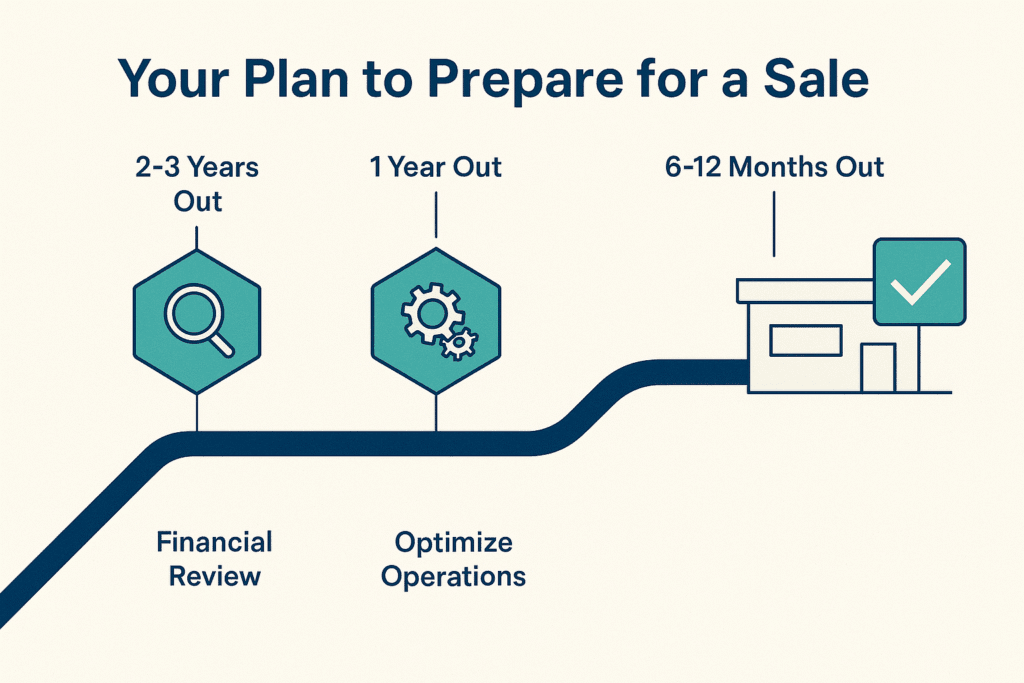

Your Plan to Prepare for a Sale

Achieving the highest possible valuation requires a strategic, multi-year approach. The process should begin two to three years before your target sale date with a thorough financial review. During this time, work with a CPA to produce clean, accrual-based financial statements and obtain a formal practice valuation to establish a baseline.

With that foundation, the next phase involves optimizing operations by focusing on the key value drivers: improving EBITDA margins, streamlining billing, and strengthening your management team. Finally, about six to twelve months before going to market, assemble your professional team. This includes an M&A advisor to create a competitive sale process, a healthcare attorney to manage legal risk, and a tax advisor or CPA to ensure the deal is structured efficiently.