As a practice owner, you know that prior authorization is an administrative headache. But it’s also a direct drag on your practice’s profitability, growth, and ultimate valuation. The hours your team spends on phones and navigating payer portals are hours not spent on patient care or revenue-generating activities. This operational inefficiency directly impacts your bottom line and what your practice is worth to a potential buyer.

For practice owners considering automation, the question is how to make a strategic investment in your practice’s future. This guide provides a clear framework for calculating the return on investment (ROI) of prior authorization automation and explains why it’s a critical step toward maximizing your practice’s value.

What Are the True Costs of Manual Prior Authorization?

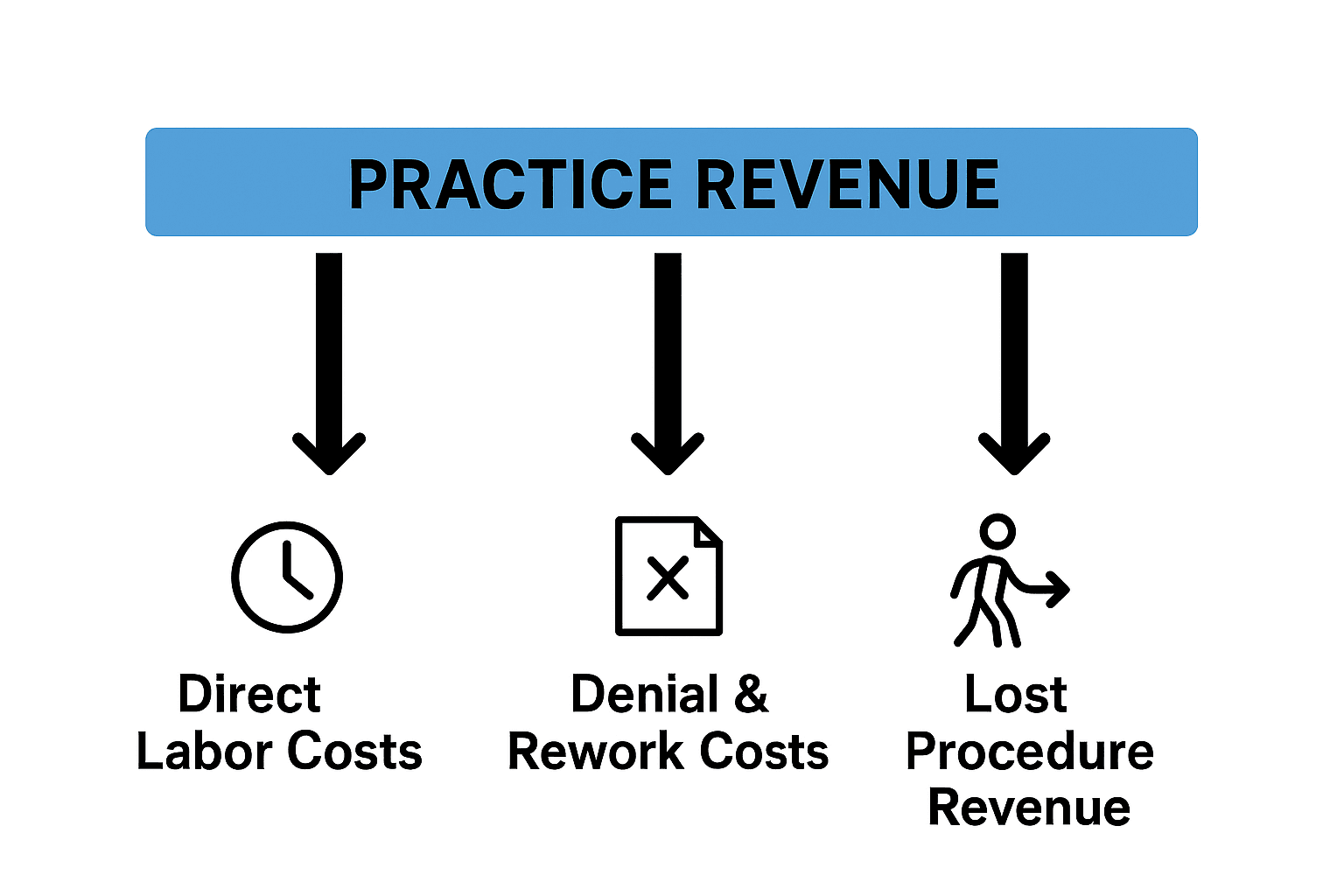

The true cost of manual prior authorizations goes beyond simple frustration. Because the responsibility for securing approval rests squarely on your practice—not the patient or the insurer—every inefficiency translates into a direct financial drain. This burden erodes your profitability in three key areas.

By the Numbers: The average practice loses nearly two workdays per physician every week to manual prior authorizations, time that could be dedicated to patient care and revenue growth.

First, direct labor costs are staggering. Your staff members dedicate countless hours to checking requirements, submitting forms, and following up, a direct result of your practice bearing the entire administrative load.

Second, process-related errors and denials create expensive rework. Manual submissions are prone to mistakes, leading to initial denial rates that can exceed 15%. Each denial requires more staff time to appeal and resubmit, multiplying the original cost and delaying payment.

Finally, the opportunity cost of treatment delays is immense. When an authorization takes days or weeks to become “resolved” (approved or denied), patients may cancel appointments, seek care elsewhere, or abandon treatment altogether. This lost revenue is a significant financial drain that many practices underestimate.

How Does a Prior Authorization Platform Solve These Problems?

Given these substantial costs, forward-thinking practices are turning to automation. A prior authorization platform is a software solution designed to eliminate the manual work that makes this process so expensive. By integrating with your Electronic Health Record (EHR) and practice management systems, automation transforms your workflow from a manual burden into a streamlined, exception-based process.

When a provider orders a service, the platform instantly checks if authorization is required. If so, it automatically gathers the necessary clinical data, populates the forms, and submits the request electronically. The software’s goal is to reach a final, resolved status—ideally an approval—in hours, not days, by continuously monitoring each request and alerting staff only when action is needed. This frees your team from manual tracking and follow-up calls entirely.

How Do I Calculate My Practice’s ROI on Automation?

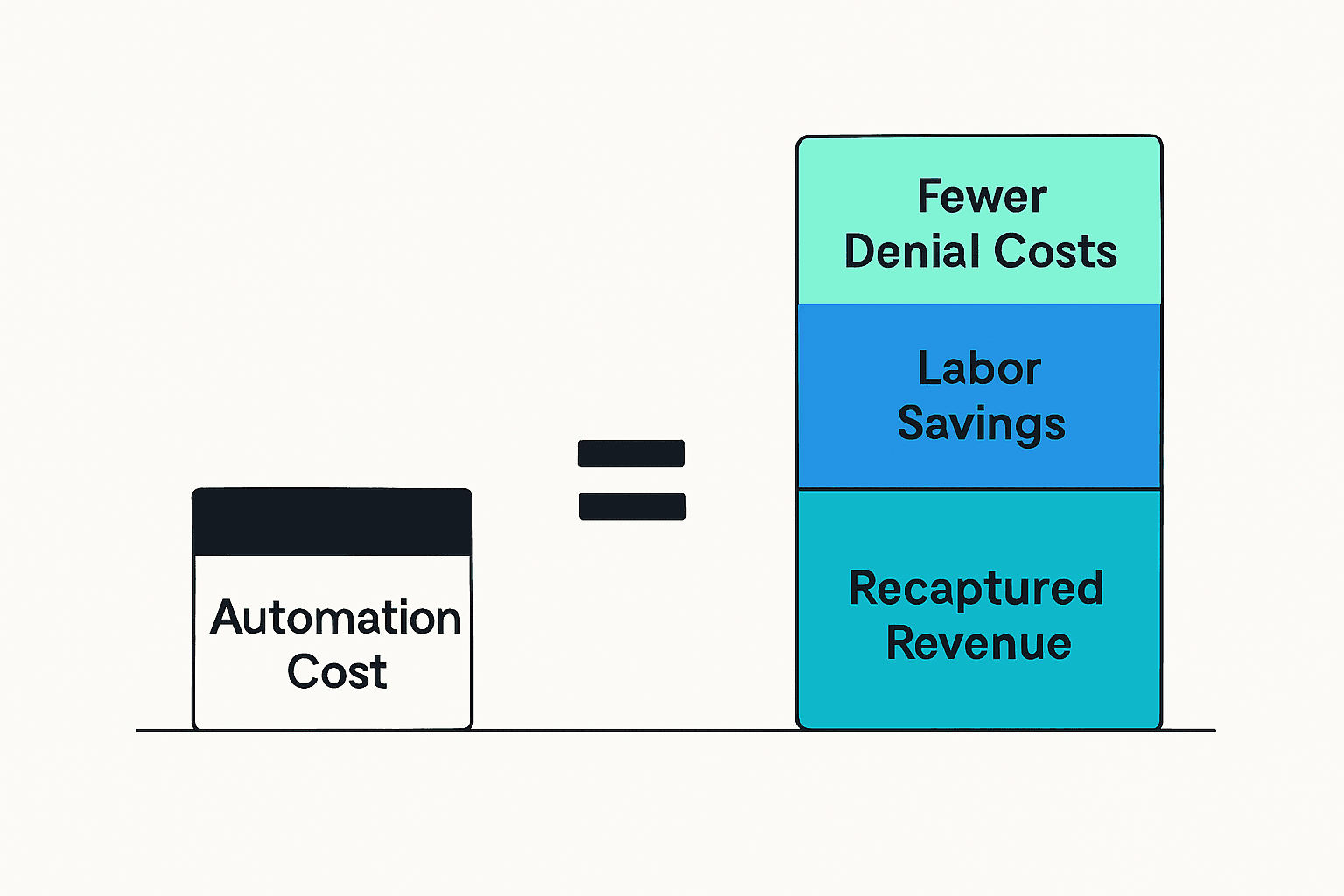

The business case for automation becomes clear when you calculate the return on investment. The process starts with a clear-eyed assessment of your current costs compared to the projected savings and platform fees. The table below breaks down the key factors.

| Cost Factor | Manual Process Impact | Automation Impact & Savings |

| Staff Labor | High cost from manual data entry, phone calls, and status tracking. (e.g., 45-60 mins/auth) | 70-80% Reduction. Staff time is reduced to minutes per authorization, focused on managing exceptions. |

| Denial & Rework Costs | High rates (15%+) due to incomplete forms and human error, requiring costly appeals. | 60%+ Reduction. AI-driven checks ensure complete documentation, drastically lowering denial rates and rework. |

| Lost Procedure Revenue | Significant revenue lost from treatment delays, appointment cancellations, and patient attrition. | 50%+ Reduction. Faster approvals (from days to hours) reduce patient drop-off and accelerate time to treatment. |

| Technology Costs | Minimal, but offset by massive hidden labor and opportunity costs. | A predictable monthly subscription and one-time implementation fee. |

To calculate your estimated annual savings, first determine your total current costs by adding up your annual labor, denial rework, and lost revenue expenses. Next, project your future costs with automation, which include the reduced costs for labor and denials plus the new technology subscription fee.

Annual ROI (%) = (Total Annual Savings / Total Annual Automation Cost) x 100

Key Takeaway: For many practices, the savings from reduced labor and recaptured revenue far outweigh the software costs, often leading to an ROI of over 500% and a payback period of just a few months.

What Are the Strategic Benefits Beyond Direct ROI?

While the financial ROI is compelling, the strategic benefits of automation create a more resilient, scalable, and valuable practice for the long term.

- Improved Staff Satisfaction: Automating tedious tasks reduces burnout and improves morale, helping you retain valuable team members.

- Enhanced Patient Experience: Faster, more reliable authorizations mean patients get the care they need without unnecessary delays, building loyalty and strengthening your reputation.

- Greater Scalability: As your practice grows, automation allows you to handle a higher volume of authorizations without proportionally increasing administrative headcount.

This newfound scalability does more than improve daily operations; it directly addresses the number one question for any practice owner: “What is my business worth?”

Why Prior Authorization Efficiency Is Critical for Your Practice’s Valuation

As a healthcare M&A advisory firm, SovDoc knows that operational efficiency is a primary driver of practice valuation. Acquirers and investors look for businesses that are scalable and not overly dependent on manual processes. A practice with an automated prior authorization workflow demonstrates management sophistication and a lower operating expense ratio.

During due diligence, high denial rates and bloated administrative teams are major red flags. They signal underlying operational risks that a buyer will have to fix, which reduces the price they are willing to pay. Conversely, a practice that has successfully implemented automation is more attractive. It has already unlocked efficiencies, improved its EBITDA margins, and proven its ability to adopt technology.

The Buyer’s Perspective: To a potential buyer, an automated practice signals efficiency and scalability. A manual one signals operational risk and hidden costs.

Ultimately, your approach to prior authorization tells a story to potential buyers. Is it a story of operational drag, hidden costs, and unrealized revenue? Or is it a story of strategic foresight, efficiency, and a practice built for scalable growth? Investing in automation is more than a solution to a daily headache; it’s a foundational step in writing the second story. It proves your practice is a sophisticated, high-value asset ready for its next chapter.

Unlock Your Practice’s True Value

Inefficient workflows like manual prior authorization can suppress your practice’s profitability and, ultimately, its valuation. At SovDoc, we specialize in helping practice owners see their business through the eyes of a buyer. We identify the operational gaps that diminish value and create a clear roadmap to maximize your M&A outcome.

Contact us today for a confidential consultation to discover how strategic operational improvements can position your practice for a premium valuation.