Your practice’s financial health and its ultimate valuation depend directly on your Revenue Cycle Management (RCM) technology. An inefficient RCM stack drains profitability through claim denials, payment delays, and wasted staff hours. A high-performing system, however, is a strategic asset that drives cash flow and supports growth strategies for independent healthcare practices.

Key Insight: Your RCM technology is not just an administrative tool. It is a critical asset that directly impacts your cash flow, profitability, and your practice’s final valuation.

This guide provides a framework for practice owners to assess their RCM technology, focusing on the key performance indicators (KPIs), system components, and strategic questions that determine whether your technology is an asset or a liability.

How Do You Measure Your Practice’s Financial Health

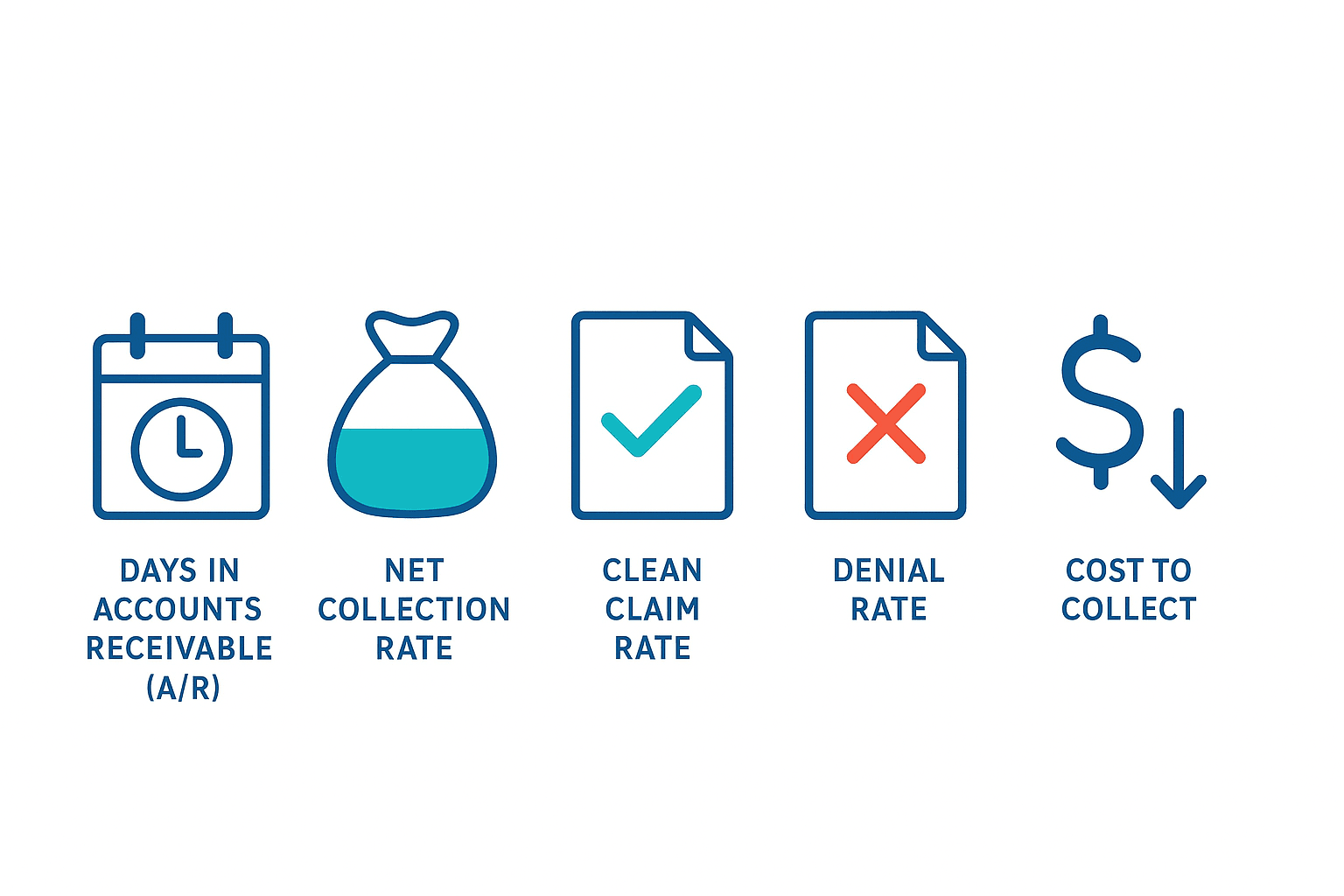

To improve your revenue cycle, you must measure it. Your RCM technology should provide a clear, real-time dashboard of the vital signs of your business. These core metrics reveal how efficiently you are being paid for your services and are fundamental to benchmarking your practice’s financials.

| Key Performance Indicator (KPI) | What It Measures | Why It Matters to a Practice Owner |

| Days in Accounts Receivable (A/R) | The average time it takes to collect payment after providing a service. | This is your cash flow speed. High A/R means your money is with payers, not in your bank. |

| Net Collection Rate | The percentage of allowed reimbursement your practice actually collects. | This is your true revenue. A low rate means you are not collecting all the money you’ve earned. |

| Clean Claim Rate | The percentage of claims accepted by a payer on the first submission. | Aim for 95%+. A high rate proves your front-end processes are efficient, cutting down on costly rework. |

| Denial Rate | The percentage of claims denied by payers. | Each denial is delayed revenue that requires expensive manual intervention to resolve. |

| Cost to Collect | The total cost of your RCM process relative to your total collections. | This is your bottom line. Lowering this cost directly increases your practice’s profitability. |

What Are the Key Stages of Your Revenue Cycle

Your revenue cycle is the complete financial journey from patient appointment to zero balance. A weakness at any stage creates downstream problems that result in lost revenue. The process begins with accurate patient registration and eligibility verification, moves to correct charge capture and coding, and then to claim submission. After submission, the cycle continues with timely payment posting, aggressive denial management, and concludes with effective patient billing and collections. An integrated technology stack ensures data flows seamlessly through these stages, which is a core component of effective healthcare practice management.

Is Your Core RCM Technology Up to the Task

Your Practice Management System (PMS) and Electronic Health Record (EHR) are the foundation of your revenue cycle. An outdated or poorly integrated system forces staff into manual workarounds and leads to missed revenue. Your PMS should automate administrative functions, while your EHR must help capture charges accurately at the point of care. If these core systems don’t work together, you will face significant technology and EMR integration challenges.

How Well Do Your Systems Talk to Each Other

Siloed systems are a primary source of revenue leakage. For an efficient RCM process, your software must communicate automatically, a concept known as interoperability. Your PMS should have deep, real-time integration with your clearinghouse, the bridge between your practice and payers. This connection enables automated “claim scrubbing” based on the latest healthcare interoperability standards, which checks for errors against payer rules before submission and drastically reduces your denial rate.

Red Flag: If your team is manually uploading claim files or working denials in a separate clearinghouse portal, your workflow is inefficient, costly, and putting your revenue at risk.

Are You Leaving Money on the Table with Denials and Payments

A modern RCM strategy is proactive, not reactive. Your technology should focus on preventing revenue loss before it happens. Instead of just managing denials, your system should provide analytics to identify the root cause so you can fix the process. Likewise, your patient billing should be simple and convenient. Technology that supports online payment portals, a key part of a patient engagement platform, accelerates patient collections and improves satisfaction.

Can You See What’s Happening in Your Revenue Cycle

You cannot manage what you cannot see. To make strategic decisions, you need access to a business intelligence platform that provides real-time dashboards. Your analytics should instantly answer critical questions about payer performance, provider productivity, and denial trends. This level of insight, similar to what’s uncovered during a Quality of Earnings analysis, transforms RCM from a cost center into a strategic tool for negotiating better payer contracts.

Your Next Steps for Assessment and Planning

Evaluating your RCM technology is a crucial step to maximize the valuation of your healthcare practice. A strong RCM stack directly increases your practice’s EBITDA, making it more valuable to potential buyers from private equity or hospital systems.

The Bottom Line: A strong RCM stack directly increases your practice’s EBITDA. This is not just an operational improvement—it is a direct investment in your practice’s valuation.

Gauge where your practice stands. An excellent system is fully integrated and highly automated. A strong system has a solid core but relies on some manual processes. If your system needs improvement, it is likely aging and causing inconsistent financial results. A deficient system is a significant barrier to profitability. Based on your assessment, prioritize investments that offer a clear return. This strategic planning is essential whether you are preparing to sell your medical practice or positioning it for future growth.

At SovDoc, we specialize in healthcare mergers and acquisitions. We know that a practice’s underlying technology is a key driver of its value. Our healthcare M&A advisory services include in-depth RCM technology assessments to help owners and investors identify opportunities, mitigate risks, and maximize financial performance.

Whether you are looking to grow, optimize, or plan your exit strategy, a powerful RCM technology stack is essential. For expert guidance on assessing your technology, contact the SovDoc healthcare transaction team today.