When you think about the value of your medical practice, your mind might go directly to the physical things—the exam tables, the diagnostic equipment, the office space. While those tangible items have worth, they often represent a small fraction of your practice’s total value. For sophisticated buyers like private equity firms and Management Services Organizations (MSOs), the most compelling assets are the ones you can’t touch.

In many mid-sized practice sales, intangible assets like patient relationships, brand reputation, and skilled staff can account for 60-80% of the final deal price.

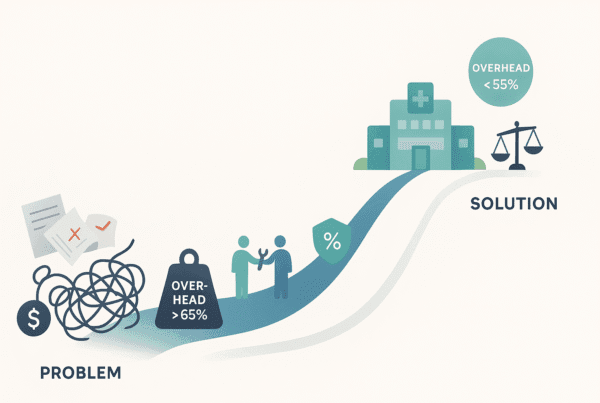

Understanding these “hidden” assets is not just an academic exercise. It is a critical component for anyone looking to get a true picture of their practice’s worth. This specialized analysis is a key part of the larger framework used to determine your medical practice’s value in today’s market. Properly identifying and quantifying these assets can dramatically increase your final valuation.

Identifying the Key Intangible Assets in a Medical Practice

Intangible assets represent the future earning power of your practice. They are the reason a buyer is willing to pay a premium over the value of your physical equipment. They are the systems, relationships, and reputation that generate consistent cash flow.

Here are the most valuable intangible assets buyers look for in a healthcare practice:

- Patient Relationships & Medical Records: This is more than just a list of names. It represents a predictable, recurring revenue stream. A buyer sees a well-managed patient database as a group of loyal customers with a history of seeking care, which lowers the risk of future revenue decline.

- Assembled Workforce & Staff Expertise: A team that works efficiently, understands your patient population, and can operate without your constant intervention is immensely valuable. It costs a new owner significant time and money to recruit, hire, and train a high-functioning team from scratch.

- Brand Reputation & Trade Name: Is your practice the go-to provider for a specific treatment in your community? That reputation, built over years of quality care and patient trust, has tangible worth. It means new patients will continue to walk through the door.

- Payer and Referral Contracts: Strong, in-network contracts with commercial payers or exclusive referral agreements with local health systems are powerful assets. A buyer inherits these relationships, saving them the lengthy and often difficult process of negotiating new terms.

- Proprietary Processes & Technology: This could include your uniquely customized EHR templates that improve efficiency, specific clinical protocols that lead to better outcomes, or a well-designed patient recall system. These are transferable systems that make the business more scalable and profitable.

How Buyers Put a Price on the Intangible

So, if you can’t see or touch these assets, how do buyers assign them a dollar value? They use established valuation methodologies that have been tested in courtrooms and boardrooms. While there are three primary approaches, one is used far more often in healthcare.

| Approach | Description | Application in Healthcare |

|---|---|---|

| Income Approach | Measures the present value of future economic benefits from the asset. | Most common. Ideal for valuing assets that generate cash flow, like patient lists and contracts. |

| Cost Approach | Estimates the cost to recreate the asset from scratch. | Used as a baseline. Good for valuing an assembled workforce or internal software. |

| Market Approach | Uses sale prices of similar assets to estimate value. | Rarely used for specific intangibles due to a lack of comparable public data. |

The Income Approach: The Industry Standard for Healthcare

This is the preferred method because it directly answers the buyer’s main question: “How much money will this asset make me in the future?” Valuation professionals use a few techniques within this approach:

- Discounted Cash Flow (DCF): This projects the future income an asset (like your patient base) will generate and then discounts it to a present-day value.

- Relief-from-Royalty Method: This is often used for brand names. It calculates value by estimating the royalty payments you would avoid by owning the brand instead of licensing it from someone else.

- With-and-Without Method: This compares the practice’s total value with a specific asset to its value without it. The difference represents the asset’s value contribution.

A Real-World Example: Seeing Intangible Value in Action

Let’s make this concrete. Imagine a three-physician primary care group is selling to a larger healthcare network. After a thorough analysis, the valuation breaks down like this:

- Tangible Asset Value (equipment, furniture): $200,000

- Value of Assembled Workforce: $150,000

- Fair Value of Patient Relationships, Contracts, & Trade Name: $900,000

Total Deal Value: $1,250,000

In this typical scenario, the intangible assets ($1,050,000) make up 84% of the total purchase price. The physical assets are just the ticket to the game; the intangibles are how you win.

Common Pitfalls: Where Practice Owners Leave Money on the Table

Without professional guidance, it’s easy to make mistakes that leave significant value on the negotiating table.

- Confusing Personal vs. Practice Goodwill: This is the most critical error. Personal goodwill is tied to you, the individual physician. Buyers will not pay for reputation that walks out the door when you retire. Practice goodwill is tied to the business—its name, location, systems, and staff—and that is what is transferable and valuable.

- Ignoring Valuable Contracts: Many owners underestimate the value of a well-negotiated payer contract or an exclusive hospital referral agreement. These are hard-won assets that derisk the investment for a buyer.

- Failing to Document Processes: The “way you do things” might be brilliant, but if it only exists in your head, it has no transferable value. Documented workflows, training manuals, and efficient protocols are sellable assets.

How SovDoc Helps You Uncover and Maximize Hidden Value

Our process is designed to turn your practice’s hidden strengths into quantifiable value that stands up to buyer scrutiny. We don’t just count the equipment; we build a defensible case for the worth of your entire operation.

- Identification: We start with a comprehensive review of your operations to create a full inventory of every valuable intangible asset, from your patient recall system to your staff’s unique expertise.

- Quantification: We apply rigorous, private-equity-grade valuation models, primarily using the Income Approach, to assign a defendable dollar value to each identified asset.

- Narration: We then weave these data points into a compelling story. We show buyers not just a list of assets, but a narrative of a scalable, profitable platform with clear growth potential. This data-driven storytelling justifies a premium valuation.

This methodical process is a core element of our complete practice value enhancement strategies, designed to ensure you achieve the maximum possible price for the business you’ve spent a lifetime building.

Your Next Steps

Your medical practice is more than just its physical location and equipment. It is a complex ecosystem of relationships, reputation, and processes that you have carefully cultivated. These intangible assets are not just a footnote in a valuation report; they are often the main story.

Ensuring they are properly identified, valued, and presented to potential buyers requires specialized expertise that goes beyond standard accounting.

Ready to understand the full value of what you’ve built? Contact SovDoc for a confidential consultation to explore the hidden worth within your practice.

Frequently Asked Questions

What are intangible assets in a healthcare practice?

Intangible assets in a healthcare practice include elements like patient relationships, medical records, assembled workforce expertise, brand reputation, payer and referral contracts, and proprietary processes and technology. These assets represent the practice’s future earning potential and generate consistent cash flow beyond physical equipment and property.

How do buyers value intangible assets in a medical practice?

Buyers primarily use the Income Approach to value intangible assets, which estimates the present value of future economic benefits generated by these assets. Techniques include Discounted Cash Flow (DCF), Relief-from-Royalty (for brand names), and the With-and-Without Method. The Cost Approach (estimating the cost to recreate the asset) and the Market Approach (comparing sale prices of similar assets) are less common in healthcare.

Why is it important to distinguish between personal goodwill and practice goodwill?

Personal goodwill is tied to the individual physician and their personal reputation, which typically does not transfer if the physician retires or leaves. Practice goodwill is tied to the business itself—its systems, staff, location, and reputation—which is transferable and valuable to buyers. Confusing the two can lead to underestimating or losing value during a sale.

What mistakes do practice owners commonly make that reduce their intangible asset value?

Common mistakes include confusing personal goodwill with practice goodwill, ignoring the value of payer and referral contracts, failing to document processes and protocols, and relying on general rules of thumb or multipliers rather than asset-specific, defensible valuation methods. These mistakes can leave significant value on the table during negotiations.

How can I maximize the value of my healthcare practice’s intangible assets before a sale?

Maximizing value involves identifying and cataloging all intangible assets, applying rigorous valuation models like the Income Approach, and building a compelling narrative around these assets to justify a premium price. Professional expertise, such as SovDoc’s valuation and storytelling process, ensures these hidden assets are clearly demonstrated and properly valued by potential buyers.