Understand what your medical practice is truly worth in today’s market—and the key factors that drive valuation multiples from 4x to 11x EBITDA.

Table of Contents

- Before We Begin: What's Your Gut Feeling?

- What Makes Healthcare Practice Valuation Unique

- EBITDA: The Foundation of Healthcare Valuations

- Valuation Multiples: What Practices Actually Sell For

- Key Factors That Impact Practice Value

- The Valuation Process: What to Expect

- Value Enhancement Strategies: Maximizing Your Practice Worth

- Common Valuation Mistakes That Cost Practice Owners

- Working with Valuation Professionals

- Taking Action: Your Next Steps

Before We Begin: What’s Your Gut Feeling?

The value of your practice isn’t determined by what you think it’s worth, or even what a formula suggests. It’s determined by what a qualified buyer is willing to pay.

Before diving into the complexities of healthcare practice valuation, take a moment to consider this question:

If you’re thinking about selling your practice, what do you believe it’s worth right now? Not what you hope it might be worth, or what you think you deserve after years of building it, but what you genuinely believe someone would pay for it today.

Keep that number in mind as we walk through this guide—because by the end, you’ll have a much clearer picture of whether your instincts align with market reality.

Here’s the truth that many practice owners discover too late: The value of your practice isn’t determined by what you think it’s worth, or even what a formula suggests. It’s determined by what a qualified buyer is willing to pay. And in today’s healthcare M&A market, that number is driven by very specific financial metrics and operational factors that sophisticated buyers evaluate with surgical precision.

At SovDoc, we’ve guided dozens of practice owners through valuations and successful exits, and we’ve seen firsthand how the right preparation and positioning can mean the difference between a disappointing outcome and a life-changing transaction.

A comprehensive valuation is the foundation of a successful practice transition strategy. Learn more about our expert valuation services.

What Makes Healthcare Practice Valuation Unique

Healthcare practice valuation operates in a fundamentally different universe than other business sectors. While a manufacturing company might be valued primarily on revenue multiples or asset replacement costs, medical practices require specialized approaches that account for the unique complexities of healthcare delivery, regulatory requirements, and cash flow patterns.

The biggest differentiator? Healthcare practices are valued almost exclusively on their ability to generate sustainable cash flow, measured through adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This focus on cash flow generation reflects the reality that medical practices are service businesses where the primary assets walk out the door each night—your providers and staff.

The Three Primary Valuation Approaches

| Approach | Best Used For | Limitations in Healthcare |

|---|---|---|

| Asset Approach | Asset-heavy practices, distressed situations | Doesn’t capture practice goodwill or earning potential |

| Market Approach | When comparable sales data exists | Limited comparable transaction data in healthcare |

| Income Approach | Most healthcare practices | Requires accurate financial projections and risk assessment |

Most healthcare transactions today use a hybrid approach that starts with the income method (EBITDA multiples) and incorporates market data where available. The asset approach typically serves as a floor value, ensuring the practice is worth at least the sum of its tangible assets.

EBITDA: The Foundation of Healthcare Valuations

In healthcare M&A, EBITDA is king. This metric strips away the noise of different capital structures, tax strategies, and accounting methods to reveal the true cash-generating potential of your practice. But calculating healthcare EBITDA isn’t as simple as plugging numbers into a formula—it requires sophisticated normalization to reflect what the practice would earn under new ownership.

Calculating Adjusted EBITDA: A Real Example

Let’s walk through a practical example using a multi-location dermatology practice:

Starting Point – Reported Financials:

- Annual Revenue: $4.2M

- Operating Expenses: $3.4M

- Net Income: $800K

- Owner Compensation: $350K

Key Normalizations:

- Market rate physician compensation: $200K

- Owner compensation adjustment: +$150K

- Personal expenses (auto, travel): +$25K

- One-time legal fees: +$15K

- Adjusted EBITDA: $990K

This $190K difference between reported net income and adjusted EBITDA represents nearly a $1.3M difference in enterprise value at a 6.75x multiple—demonstrating why proper normalization is crucial.

Common Healthcare EBITDA Adjustments

Owner-Related Adjustments:

- Above-market owner compensation

- Personal expenses run through the practice

- Family member compensation above market rates

- Owner benefits and perquisites

Operational Adjustments:

- One-time professional fees or settlements

- Non-recurring equipment purchases

- Discontinued service lines

- Below-market related-party transactions

To learn more about the nuances of healthcare EBITDA calculations and normalization, check out our detailed guide on EBITDA Explained for Physicians.

Valuation Multiples: What Practices Actually Sell For

The healthcare M&A market has experienced significant multiple expansion over the past five years, driven by private equity consolidation and demographic trends. However, multiples vary dramatically by specialty, practice size, and operational characteristics.

2025 Market Multiples by Specialty

| Specialty | EBITDA Range | Typical Multiple | Revenue Multiple |

|---|---|---|---|

| Dermatology | $1-5M | 5.4x – 8.3x | 2.8x – 4.1x |

| Plastic Surgery | $1-10M | 6.8x – 11.3x | 3.2x – 6.0x |

| Behavioral Health | $1-3M | 5.2x – 7.9x | 2.1x – 3.8x |

| Primary Care | $500K-2M | 4.8x – 6.2x | 1.8x – 2.6x |

| Specialty Medicine | $1-8M | 5.6x – 8.8x | 2.6x – 4.1x |

The key insight: Practices with EBITDA above $1M consistently command higher multiples than smaller practices, regardless of specialty. This reflects reduced execution risk and greater scalability potential that institutional buyers value.

Factors That Drive Multiple Premiums

High-Multiple Characteristics:

- EBITDA above $1M annually

- Multiple locations or expansion potential

- Associate-driven vs. owner-dependent model

- Strong commercial payer mix (>60%)

- Ancillary revenue streams

- Proprietary systems or technology

Multiple Compression Factors:

- Heavy government payer reliance

- Single-provider dependency

- Declining revenue trends

- Regulatory compliance issues

- Limited growth runway

For specialty-specific multiple analysis and current market trends, check out our comprehensive guide on Valuation Multiples by Medical Specialty.

Key Factors That Impact Practice Value

Understanding what drives practice valuations beyond the basic multiple calculation is crucial for both buyers and sellers. The same practice can receive vastly different valuations depending on how these factors are positioned and presented.

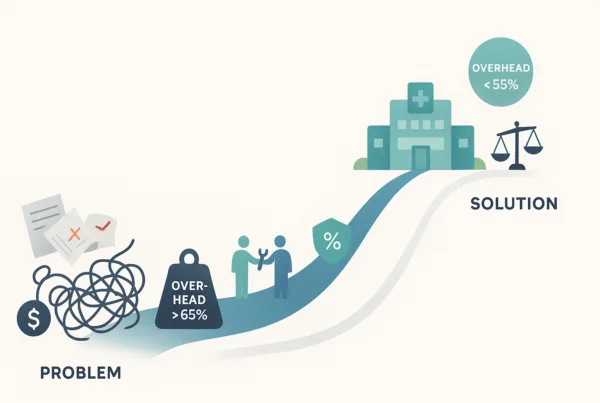

Payer Mix: The Silent Value Driver

Your payer mix composition has an outsized impact on practice value because it directly affects both current profitability and future sustainability. Commercial payers typically reimburse at rates 89% higher than Medicare, creating substantial valuation differences between practices with varying payer compositions.

Premium Payer Mix Profile:

- Commercial insurance: 65%+

- Medicare/Medicaid: <30%

- Cash pay/cosmetic: 5-15%

Valuation Risk Factors:

- Government payer percentage increasing annually

- Concentration risk with single large contracts

- Pending payer contract renegotiations

- Geographic demographic shifts toward Medicare

The long-term trend toward government payers (projected to reach 52% of total healthcare spending by 2028) creates particular valuation pressure for practices with aging patient demographics.

Operational Factors That Command Premium Valuations

Provider Structure: Associate-driven practices consistently receive higher multiples than owner-operator models because they demonstrate sustainability beyond the current owner. Buyers pay premiums for practices that won’t collapse if the founder leaves.

Growth Trajectory: Practices showing consistent growth over 3+ years receive valuation premiums, while declining or erratic revenue trends create buyer concerns about future viability.

Operational Efficiency: High-margin practices with streamlined operations command premium multiples. Key metrics include:

- Provider productivity vs. benchmarks

- Staff efficiency ratios

- Technology adoption and integration

- Quality metrics and patient satisfaction

Intangible Assets: The Hidden Value Components

Healthcare practices possess numerous valuable intangible assets that significantly impact overall valuation but require specialized assessment to quantify properly.

High-Value Intangibles:

- Practice goodwill and reputation

- Trained workforce and systems

- Electronic health records and technology

- Location advantages and lease terms

- Referral relationships and networks

- Licensing agreements and contracts

The key distinction: Professional goodwill attached to individual physicians may not transfer with practice ownership, while practice-based goodwill related to location, systems, and reputation typically does transfer and commands significant value.

To learn more about maximizing these often-overlooked value drivers, check out our detailed guide on Valuing Intangible Assets in Healthcare.

The Valuation Process: What to Expect

Professional healthcare practice valuation follows a structured process that typically takes 4-8 weeks, depending on practice complexity and financial documentation quality.

Phase 1: Financial Analysis and Normalization (1-2 weeks)

- Historical financial statement review (typically 3-5 years)

- EBITDA calculation and normalization adjustments

- Working capital analysis

- Debt and capital structure assessment

Phase 2: Market Analysis and Multiple Determination (1 week)

- Comparable transaction research

- Market condition assessment

- Multiple range determination based on practice characteristics

- Scenario modeling (base case, upside, downside)

Phase 3: Quality of Earnings Assessment (2-3 weeks)

- Revenue quality analysis and sustainability assessment

- Expense normalization and recurring cost identification

- Payer contract review and reimbursement analysis

- Operational risk assessment

Phase 4: Valuation Report and Recommendations (1-2 weeks)

- Comprehensive valuation report preparation

- Value enhancement opportunity identification

- Strategic positioning recommendations

- Transaction structure considerations

Documentation Requirements:

- Tax returns (3-5 years)

- Financial statements and P&L reports

- Provider compensation details

- Payer contracts and fee schedules

- Patient demographic and volume data

- Accounts receivable aging reports

For a comprehensive overview of what buyers examine during financial due diligence, check out our detailed guide on Financial Due Diligence Guide.

Value Enhancement Strategies: Maximizing Your Practice Worth

The best time to think about practice valuation is 2-3 years before you plan to sell. This timeline allows for strategic improvements that can significantly impact final transaction value.

Quick Wins (3-6 months)

- Clean up financial reporting: Ensure consistent, professional bookkeeping and separate business from personal expenses

- Optimize payer contracts: Renegotiate below-market contracts and eliminate unfavorable terms

- Improve operational metrics: Focus on patient retention, appointment efficiency, and collection rates

- Document systems and procedures: Create operational manuals that demonstrate transferable systems

Medium-Term Strategies (6-18 months)

- Build management depth: Reduce owner dependency by developing strong administrative teams

- Expand service offerings: Add profitable ancillary services or new revenue streams

- Technology upgrades: Implement systems that improve efficiency and patient experience

- Associate development: Transition from owner-operator to owner-supervisor model

Long-Term Positioning (18-36 months)

- Multi-location expansion: Develop additional locations or acquire complementary practices

- Specialty focus: Develop niche expertise in high-value service areas

- Value-based care participation: Position for favorable healthcare delivery model changes

- Strategic partnerships: Develop referral relationships and collaborative arrangements

The ROI of preparation is substantial: Practices that undergo systematic value enhancement typically achieve 15-25% higher transaction values compared to unprepared sales.

For detailed implementation strategies and timelines, check out our comprehensive guide on Practice Value Enhancement Strategies.

Common Valuation Mistakes That Cost Practice Owners

After reviewing hundreds of practice valuations, we’ve identified recurring mistakes that can significantly impact transaction outcomes:

Financial Preparation Errors

- Inadequate EBITDA normalization: Failing to properly adjust for owner-specific expenses and one-time items

- Poor financial documentation: Inconsistent bookkeeping that raises buyer concerns about financial reliability

- Unrealistic multiple expectations: Applying outdated or inappropriate benchmarks to current market conditions

Strategic Positioning Mistakes

- Timing the market poorly: Trying to sell during industry uncertainty or practice decline periods

- Inadequate preparation time: Rushing to market without addressing fixable operational issues

- Owner dependency concerns: Failing to demonstrate practice sustainability beyond current ownership

Process Management Issues

- Single buyer approach: Negotiating with only one potential buyer instead of creating competitive tension

- Inadequate professional support: Attempting complex valuations without specialized healthcare M&A expertise

- Poor transaction structure planning: Ignoring tax implications and deal structure optimization

Working with Valuation Professionals

Healthcare practice valuation requires specialized expertise that goes far beyond traditional business valuation. The stakes are too high and the process too complex for trial-and-error approaches.

When to Engage Professional Help

- Pre-sale planning: 2-3 years before intended transaction for value enhancement

- Transaction preparation: 6-12 months before going to market

- Dispute resolution: For partnership disputes or legal proceedings

- Strategic planning: Major practice changes or expansion decisions

SovDoc’s Approach to Healthcare Valuations

We combine private equity-grade financial analysis with deep healthcare industry expertise to deliver valuations that stand up to buyer scrutiny and maximize transaction outcomes.

Our process includes:

- Proprietary market data: Real-time transaction multiples from our deal database

- Specialized normalization: Healthcare-specific EBITDA adjustments and quality of earnings analysis

- Strategic positioning: Value enhancement recommendations and competitive positioning

- Transaction support: Seamless transition from valuation to successful exit execution

The difference: We don’t just tell you what your practice is worth—we help you understand how to maximize that value and execute a successful transaction.

Taking Action: Your Next Steps

Understanding your practice’s current value is just the beginning. The real opportunity lies in the strategic decisions you make based on that knowledge.

Immediate Action Items

- Gather your financial documentation from the past 3-5 years

- Calculate a preliminary adjusted EBITDA using the framework in this guide

- Assess your practice against the value drivers we’ve outlined

- Identify quick wins that could improve your valuation profile

Strategic Considerations

- Timeline planning: When do you realistically want to explore a transaction?

- Value enhancement opportunities: What improvements would have the highest ROI?

- Market positioning: How does your practice compare to others in your specialty and market?

- Professional team assembly: What expertise do you need to maximize outcomes?

Remember that number you thought of at the beginning of this guide? How does it compare to what you understand now about healthcare practice valuation? Whether your initial instinct was conservative or optimistic, you now have the framework to make informed decisions about your practice’s value and future.

The healthcare M&A market continues to evolve rapidly, with new buyer types, changing multiples, and shifting strategic priorities. Success requires not just understanding current values, but positioning your practice for the market conditions you’ll face when you’re ready to transact.

At SovDoc, we help practice owners navigate this complexity with confidence, combining rigorous financial analysis with strategic positioning to achieve optimal outcomes. Whether you’re curious about your current value or ready to begin serious preparation for a future transaction, we’re here to help you understand and maximize what you’ve built.

Ready to understand what your practice is truly worth? Contact our team for a confidential valuation consultation and discover how to position your practice for maximum value in today’s market.