You have spent years building your medical practice into a successful, reputable enterprise. Now, as you consider its future, your focus shifts to a critical question: how can you maximize the value of this asset you have worked so hard to create?

The final number on a sale agreement is not determined the day you decide to sell. It is the result of deliberate, strategic actions taken over several years. This guide provides a roadmap for implementing the very changes that sophisticated buyers—from private equity firms to hospital systems—pay a premium for.

This guide assumes you have a baseline understanding of what your practice is worth today. If not, we recommend starting with our complete guide on how to value a medical practice in 2025.

The Three-Year Runway: Why Preparation is Everything

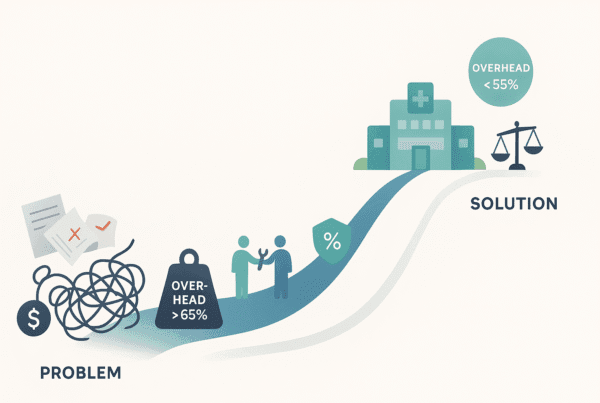

The most significant mistake a practice owner can make is waiting until they are ready to exit to think about value. Buyers purchase proven, sustainable performance, not potential promised by last-minute changes. A strategic value enhancement plan requires a runway of at least 18 to 36 months to implement changes and demonstrate their impact through clean financial data.

Starting early allows you to move from simply running a practice to building an enterprise—a business with systems, strategies, and a growth story that is compelling to an outside investor.

Driving Your Multiple with Operational Excellence

The engine of your practice’s valuation is its Adjusted EBITDA. Improving operational efficiency directly increases this number, which in turn increases your enterprise value.

While a clean P&L is essential, true value comes from the story the numbers tell. Our EBITDA normalization guide for healthcare covers the accounting side in detail. Here, we focus on the operational changes that boost performance.

- Increase Patient Throughput: Buyers analyze your efficiency closely. By standardizing clinical workflows, optimizing staff roles, and leveraging technology for administrative tasks, you can increase patient visits per provider. Practices demonstrating 2-3x higher patient throughput per physician often command higher valuations because they have a more robust revenue pipeline.

- Strengthen Your Revenue Cycle: A high collections rate and a low denial rate are signs of a well-run business. Focus on improving your revenue cycle management (RCM) by training staff on proper coding, automating eligibility checks, and diligently following up on aged accounts. This enhances cash flow and demonstrates operational control.

- Align Provider Compensation: Transitioning from an owner-centric compensation model to a market-rate structure for all providers is crucial. For your associate physicians, implement compensation plans that reward productivity and quality outcomes. This shows a buyer that your team is stable and motivated, reducing the perceived risk of key staff departing after the sale.

Strategic Growth: Diversifying to De-Risk and Expand Value

A practice with multiple, stable revenue streams is inherently less risky and more valuable than a single-service business. Strategic growth is about expanding your financial base and market presence.

Adding Profitable Ancillary Services

Ancillary services are non-core offerings that generate additional income and deepen patient relationships. For a buyer, they represent significant, diversified cash flow. Integrating ancillary services like in-house labs, imaging, physical therapy, or infusion centers can increase a practice’s final deal value by 15-30%.

Common examples include:

* An orthopedic practice adding an in-house physical therapy center.

* A dermatology clinic offering cosmetic procedures or a med-spa.

* A large primary care group integrating an urgent care clinic.

Geographic and Vertical Integration

Buyers often seek a broader patient base and integrated service lines. Geographic expansion into new markets can increase your overall enterprise value. Equally powerful is vertical integration, such as a specialty practice partnering with home health or post-acute care providers. In 2025, home health and hospice organizations saw some of the most robust M&A activity, highlighting the value of a continuum of care.

Optimizing Your Payer Mix

Your mix of commercial versus government payers is a powerful value lever. Your payer mix has a profound effect on what buyers will pay. You can learn more about the impact of payor mix on valuation in our dedicated guide. Beyond the current mix, you can enhance value by proactively renegotiating below-market contracts and exploring a shift toward value-based care (VBC) arrangements. Practices that have moved at least 30% of their revenue to VBC contracts typically see higher valuation multiples by medical specialty because they are aligned with modern reimbursement models.

The Digital Upgrade: Using Technology to Command a Premium

In today’s M&A environment, technology is not just an expense; it is a critical asset that demonstrates scalability, efficiency, and a modern approach to care delivery. Practices that show a compelling ROI on technology investments achieve premium valuations.

| Technology Investment | How It Increases Valuation |

|---|---|

| Integrated Telehealth Platform | Expands patient access, grows revenue (up to 20%), and lowers attrition. Demonstrates adaptability. |

| “Digital Front Door” Solutions | Tools like online scheduling and patient portals improve patient experience and reduce administrative burden. |

| EHR Optimization & Analytics | A well-used EHR provides clean data for due diligence and allows for tracking KPIs, showing a data-driven culture. |

| AI-Driven Patient Engagement | Automated communication tools improve retention and care plan adherence, boosting long-term patient value. |

Implementing new systems is not without its hurdles. Be sure to review common technology and EMR integration challenges as you plan your upgrades.

Building a Moat: Documentation and Compliance

The final pillar of value enhancement involves de-risking the business. Sophisticated buyers conduct extensive due diligence, and being prepared can protect your valuation and accelerate the closing process.

- Prepare for Due Diligence Now: Do not wait for a buyer’s request list. Proactively assemble robust documentation for all financials, provider productivity, quality metrics, and operational procedures. This creates a professional impression and builds buyer confidence.

- Solidify Key Contracts: Ensure all key provider employment agreements, vendor contracts, and property leases are well-documented, current, and transferable. Ambiguity in contracts creates risk, and risk reduces value.

- Stay Ahead of Regulatory Risk: Maintain a spotless compliance record with healthcare regulations like Stark Law and Anti-Kickback statutes. A clean compliance history reduces a buyer’s perceived legal risk and is a non-negotiable for institutional investors.

Your Value Enhancement Roadmap

Maximizing your practice’s value is a deliberate process, not an accident. The strategies you implement in the years leading up to a sale will directly dictate the outcome. By focusing on operational excellence, strategic growth, technological upgrades, and diligent preparation, you build a resilient and highly valuable enterprise that is attractive to the market’s best buyers.

If you are ready to create a strategic plan to position your practice for a premium exit, our team at SovDoc can help. Contact us to discuss our Prepare a Medical Practice for Sale and Healthcare Strategic Planning advisory services.

Frequently Asked Questions

What are the most effective strategies to increase the value of my medical practice?

The most effective strategies include improving operational efficiency to boost EBITDA, diversifying revenue streams with profitable ancillary services, optimizing your payer mix by negotiating contracts and adopting value-based care models, integrating advanced technologies like telehealth and EHR analytics, and ensuring robust documentation and compliance to reduce risks and streamline due diligence.

How long should I prepare my medical practice before selling to maximize its value?

A preparation period of 18 to 36 months (1.5 to 3 years) is ideal. This runway allows you to implement strategic changes and demonstrate sustainable performance improvements, which sophisticated buyers value highly, rather than relying on last-minute fixes.

Can adding ancillary services really increase my practice’s sale price?

Yes, adding profitable ancillary services like in-house labs, imaging, physical therapy, or cosmetic procedures can increase your practice’s deal value by 15-30%. These services provide diversified revenue streams with higher margins, which buyers find attractive due to reduced risk and enhanced cash flow.

How does technology investment impact medical practice valuation?

Investing in technology demonstrates scalability and modern operations to buyers, directly increasing valuation. Examples include integrated telehealth platforms that can grow revenue by up to 20%, digital front door solutions that enhance patient experience, and optimized EHR systems that provide clean data for due diligence and KPI tracking. These technologies position your practice as forward-thinking and efficient.

What operational metrics and practices are most important to buyers when assessing my medical practice?

Buyers focus on metrics such as Adjusted EBITDA as the core measure of profitability, patient throughput demonstrating operational efficiency, revenue cycle management performance (high collections and low denials), and provider compensation structures that align pay with productivity and quality. These metrics and practices indicate a stable, well-run practice with predictable cash flow and low risk.