After months of preparation, you’ve received a Letter of Intent (LOI) to acquire your medical practice. The valuation meets your expectations, and the terms seem right. But the deal is far from done. In fact, the most intense part of the process is just beginning: financial due diligence.

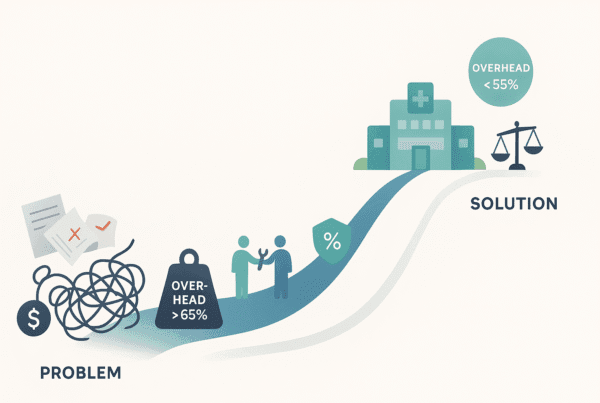

Think of the LOI as a hypothesis. The buyer is stating, “Based on the information you’ve provided, we believe your practice is worth X.” Financial due diligence is the rigorous, evidence-based process they use to test that hypothesis. They will put every financial claim under a microscope to verify your practice’s health, profitability, and risk profile.

This critical step directly follows the initial assessment outlined in our complete guide to medical practice valuation. Being ready for it can make the difference between a smooth closing at your expected price and a frustrating process that ends in valuation cuts or a broken deal.

Beyond the Audit: The Real Goal of Financial Due Diligence

Many practice owners mistakenly believe that if their books are clean and their tax returns are filed, they are prepared for due diligence. The process goes much deeper than a standard financial audit.

The primary goal of financial due diligence is to produce a Quality of Earnings (QoE) analysis. This is a specialized report, usually prepared by the buyer’s advisory team, that aims to determine the true, sustainable cash flow of your practice. It answers one key question for the buyer: “What level of EBITDA can we realistically expect this practice to generate under our ownership?”

A traditional audit looks backward to verify that past financial statements comply with accounting principles. A QoE analysis is forward-looking. It scrutinizes your revenue and expenses to identify anomalies, non-recurring items, and risks that could impact future performance. It is the bedrock upon which the final purchase price is built, and it’s why expert CPA firms play a critical role on the buyer’s side.

The Five Pillars of a Healthcare Financial Review

Sophisticated buyers and their advisors focus their investigation on five key areas. Understanding these will help you prepare for the questions and data requests that are sure to come.

1. Revenue Quality and Reimbursement Analysis

A buyer won’t just look at your top-line revenue; they will dissect its quality and sustainability.

– Payer Mix Verification: They will validate the percentage of revenue from each payer (Medicare, Medicaid, commercial, self-pay) to assess risk and profitability.

– Billing & Coding Audits: Expect them to sample patient charts and reconcile them with billing records. This is to ensure you are coding correctly and not at risk for future take-backs or compliance penalties.

– Volume & Procedure Trends: They will analyze patient volume, referral patterns, and the mix of procedures performed to check for any recent, unexplained spikes that might not be sustainable.

2. EBITDA Normalization and Expense Scrutiny

The Adjusted EBITDA figure you presented is the foundation of your valuation, and buyers will challenge every single adjustment.

– Add-Back Verification: Be prepared to provide detailed documentation for every expense you’ve “added back” to your earnings, from owner-related perks and travel to one-time legal fees or equipment purchases.

– Compensation Analysis: They will scrutinize physician and staff compensation, comparing it to industry benchmarks to see if it is artificially low (or high), which would require adjustment post-transaction.

– Related-Party Transactions: Any payments to entities owned by you or your family (such as rent for a building you own) will be reviewed to ensure they are at a fair market rate.

3. Working Capital and Cash Flow

Buyers need to ensure the practice has enough cash on hand to operate smoothly from Day One.

– Accounts Receivable (A/R) Aging: A deep dive into your A/R aging reports will reveal how effectively you collect payments. A high number of days in A/R (over 60) is a major red flag.

– Denial and Write-Off Analysis: High rates of claim denials or large write-offs signal potential problems in your revenue cycle management.

– Net Working Capital Target: Buyers will establish a “net working capital peg” or target. If the actual working capital at closing is below this target, the difference is often deducted from your proceeds.

4. Tax and Corporate Structure Review

This is a check for skeletons in the closet. The buyer’s team will review 3-5 years of federal and state tax returns, payroll filings, and sales tax records to confirm full compliance and identify any outstanding liabilities that could transfer with the business.

5. Regulatory and Compliance Check

In healthcare, financial health and regulatory compliance are inseparable. A buyer’s diligence team will assess your risk by reviewing:

– Provider Licenses & Certifications: Ensuring all clinicians are properly credentialed and in good standing.

– HIPAA Compliance: Reviewing your policies, procedures, and any history of breaches.

– Stark Law & Anti-Kickback: Examining referral patterns and compensation arrangements to ensure they comply with federal laws. A misstep here can carry huge liabilities.

Your Financial Due Diligence Data Checklist

Being organized is your best defense. The buyer will establish a virtual data room and request a large volume of documents. Having these materials ready will speed up the process and signal that you run a professional operation. For an even more exhaustive list, see our Private Equity Due Diligence Checklist for Practices.

| Category | Data to Collect and Analyze |

|---|---|

| Financial Statements | 3-5 years of audited or reviewed financials; internal monthly P&L and balance sheets. |

| Billing & Collections | Payer mix reports; A/R aging by payer; top CPT codes billed; denial logs; collection agency reports. |

| Expense Analysis | Detailed payroll records; owner and provider compensation reports; major vendor contracts; lease agreements. |

| Tax Compliance | Federal, state, and local tax returns (3-5 years); payroll tax filings; proof of any tax liens or disputes. |

| Regulatory & Legal | All professional licenses and certifications; results of any past OIG, Medicare, or state audits. |

| Contracts | All payer agreements; physician employment contracts; major supplier and service contracts. |

Deal-Killing Red Flags: What Buyers Fear Most

During due diligence, buyers are looking for reasons not to do the deal, or at least to lower the price. Here are some of the most common red flags they look for:

- Sharp or unexplained increases in revenue in the 12 months leading up to a sale.

- High dependency on a single referring physician or a single payer contract.

- Inconsistent financial reporting or messy QuickBooks files.

- Poor documentation to support EBITDA “add-backs.”

- Above-average claims denial rates or A/R days outstanding greater than 60 days.

- Unclear or undocumented related-party transactions (e.g., rent paid to a family-owned LLC without a formal lease).

- Any history of unresolved tax or regulatory compliance issues.

How SovDoc Turns Due Diligence from a Liability into an Asset

The due diligence process can feel overwhelming and invasive. An experienced advisor acts as your shield and your guide, managing the flow of information and defending your practice’s value.

At SovDoc, we help you prepare by conducting our own “seller-side” diligence before your practice ever goes to market. We identify the potential red flags and help you fix them on your terms. When a buyer’s request list arrives, we are already prepared.

We manage the entire process, from building the secure data room to coordinating with your accountant and legal counsel. We analyze every buyer request to understand the “question behind the question,” ensuring we provide the right information without giving away unnecessary leverage. This proactive approach turns due diligence from a defensive battle into a process that validates and reinforces your practice’s value.

Due diligence is the ultimate test of your practice’s quality and your preparedness as a seller. Passing it with flying colors not only protects your valuation but also leads to a smoother, faster, and far less stressful closing.

Is your practice ready for the intense scrutiny of a buyer’s due diligence? Contact SovDoc for a confidential consultation to ensure your financials are prepared to defend and maximize your valuation.

Frequently Asked Questions

What is financial due diligence in the context of selling a healthcare practice?

Financial due diligence in healthcare is a comprehensive, data-driven investigation conducted by the buyer to verify the true financial health, profitability, and risks of a medical practice. This process goes beyond standard audits and focuses on validating the sustainable cash flow and true earnings potential through a Quality of Earnings (QoE) analysis.

What are the key areas buyers focus on during financial due diligence for a medical practice sale?

Buyers concentrate on five main areas: 1) Revenue quality and reimbursement analysis including payer mix and billing accuracy; 2) EBITDA normalization and scrutiny of expense add-backs; 3) Working capital review including accounts receivable aging and cash flow; 4) Tax and corporate structure compliance; and 5) Regulatory and compliance checks such as HIPAA and Stark Law adherence.

What documents should I prepare to satisfy the buyer’s financial due diligence requests?

You should organize: 3-5 years of financial statements including audited and internal reports; billing and collections data like payer mix and denial logs; detailed payroll and expense records; federal and state tax returns for multiple years; all licensing and compliance documents; plus contracts with payers, physicians, and vendors. Having these ready streamlines the process and signals professionalism.

What are common financial red flags that can jeopardize a medical practice sale?

Red flags include unexplained revenue spikes shortly before sale, heavy reliance on a single payer or referring physician, inconsistent or poorly documented financial records, unsupported EBITDA add-backs, high accounts receivable days exceeding 60, large claim denials, related-party transactions without formal agreements, and unresolved compliance or tax issues.

How can SovDoc assist me during the financial due diligence process of selling my medical practice?

SovDoc provides expert seller-side financial due diligence to identify and correct potential red flags before going to market. They manage the entire buyer diligence process including data room setup, coordinating responses with your advisors, and protecting your valuation by controlling information flow and defending your financials during negotiations, transforming due diligence from a liability into a strategic asset.