A Quality of Earnings (QoE) analysis is a forensic financial review that validates your medical practice’s true earning power for a buyer. This guide explains what a QoE report reveals and why it’s a non-negotiable part of modern healthcare M&A.

Your profit and loss (P&L) statement tells a story about your practice’s past performance. But when you prepare to sell, sophisticated buyers are interested in a different story—one about future, sustainable cash flow. They get this story from a Quality of Earnings (QoE) analysis.

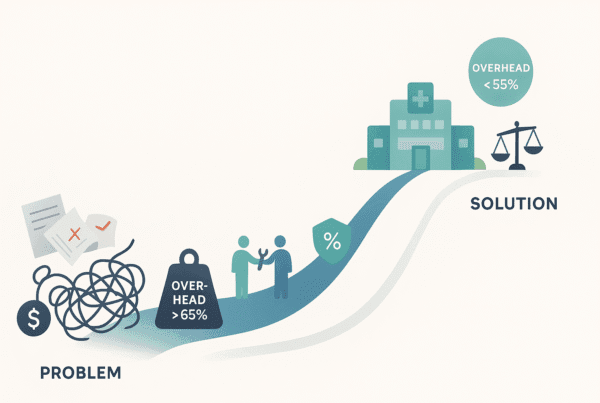

A QoE report digs much deeper than standard financial statements. It scrutinizes your revenue, costs, and operations to distinguish stable, recurring profits from one-time events and owner-specific financial decisions. This process is a critical step in any serious medical practice valuation because it establishes the Adjusted EBITDA figure upon which your entire deal value is based. For a seller, understanding this process is essential for protecting your valuation and ensuring a smooth transaction.

QoE vs. Standard Audit: A Critical Distinction for Practice Owners

You might think, “My CPA audits my books every year. Isn’t that enough?” This is a common and understandable question, but an audit and a QoE serve entirely different purposes.

An audit confirms that your financial statements are accurate and comply with Generally Accepted Accounting Principles (GAAP). It’s a backward-looking check for accuracy. A QoE analysis is a forward-looking assessment of your practice’s ability to generate cash flow for a new owner.

Think of it this way:

* An audit is like a vehicle history report. It confirms the logbook is accurate and there are no recorded accidents.

* A QoE analysis is like a pre-purchase mechanical inspection. A master mechanic puts the car on a lift, checks the engine, and tells the buyer how it will likely perform for the next five years.

| Feature | Financial Audit | Quality of Earnings (QoE) Analysis |

|---|---|---|

| Primary Goal | Verify historical accuracy and compliance with GAAP. | Assess future earnings sustainability and risks. |

| Perspective | Backward-looking. | Forward-looking. |

| Focus | Adherence to accounting rules. | True, normalized cash flow (Adjusted EBITDA). |

| Typical User | Lenders, stakeholders, internal management. | M&A buyers, private equity investors, and sellers. |

This distinction is why buyers insist on a QoE. It’s also why a seller-initiated QoE can be a powerful strategic tool, giving you control over your financial narrative. This diligence goes beyond the standard services offered by most CPA firms in healthcare transactions, focusing squarely on M&A readiness.

The Core Components of a Healthcare QoE Analysis

A QoE investigation is methodical, focusing on the key drivers of profitability and risk in a medical practice. Here’s what analysts scrutinize.

Revenue Sustainability and Payer Mix

A buyer needs to know that your revenue isn’t just a temporary spike. The analysis will dissect:

* Recurring vs. Non-Recurring Revenue: Did a one-time event, like a government relief fund (e.g., PPP loans) or a short-term high-volume service (e.g., COVID-19 testing), inflate your recent revenue? These amounts are removed to show the underlying, repeatable revenue.

* Payer Concentration: Is your practice overly dependent on a single insurance payer? If more than 30% of your revenue comes from one source, it’s a significant risk factor that will be flagged.

* Reimbursement Rate Analysis: Analysts will look at your most common CPT codes and compare your current reimbursement rates to what the acquirer receives. This models potential revenue increases or decreases after the sale.

True Cost Structure and EBITDA Normalization

This is where your practice’s reported profit is transformed into its true earning power. The goal is to calculate a normalized EBITDA by making specific adjustments, or “add-backs.”

Common adjustments include:

* Owner-Related Expenses: Removing costs that a new owner would not incur, like the owner’s car lease, personal travel, or above-market family member salaries.

* Owner Compensation: Adjusting the owner-physician’s salary to a fair market rate for a replacement provider. If you pay yourself below market rate, this can be an upward adjustment.

* Non-Recurring Costs: Adding back one-time expenses that won’t repeat, such as a major lawsuit settlement, a significant software implementation fee, or unusual repairs.

This detailed review provides the auditable, third-party proof behind the figures in our EBITDA normalization guide.

Accounts Receivable (AR) and Cash Flow Health

How effectively your practice turns billings into cash is a direct indicator of its operational health. A QoE report examines:

* AR Aging: A healthy practice typically has less than 10-15% of its accounts receivable aged over 90 days. Higher percentages signal problems with your billing process and may lead to a valuation adjustment.

* Collections Velocity: The average number of days it takes to collect payment (Days Sales Outstanding) is compared to industry benchmarks. A slow cycle can indicate inefficiencies that will need to be fixed post-acquisition.

Net Working Capital

The QoE analysis helps establish a “Net Working Capital (NWC) target.” This is a crucial, often misunderstood part of a deal. The NWC target ensures that when you hand over the keys, you leave enough cash in the business for the new owner to cover near-term operating expenses like payroll and supplies. The QoE provides an objective, data-driven basis for negotiating this target so there are no surprises at closing.

How a QoE Benefits Both Buyer and Seller

While typically driven by the buyer, a QoE analysis delivers crucial benefits to both parties in a transaction.

For the Buyer:

* Confidence: It provides third-party validation that the practice’s earnings are real, sustainable, and as advertised.

* Risk Identification: It uncovers hidden liabilities, operational weaknesses, or customer concentration issues before the deal closes.

* Integration Planning: The findings inform the buyer’s 100-day plan for operational improvements post-acquisition.

For the Seller:

* Protects Valuation: By identifying and documenting add-backs upfront, you establish a strong, defensible Adjusted EBITDA. This prevents a buyer from finding issues during their diligence and using them to “re-trade” the deal for a lower price.

* Increases Credibility: Presenting a sell-side QoE report shows you are a serious, transparent seller, which builds trust and attracts premium buyers.

* Speeds Up the Process: It anticipates and answers most of a buyer’s financial questions, dramatically shortening the due diligence timeline and reducing deal fatigue.

How SovDoc Uses QoE to Maximize Your Practice’s Value

At SovDoc, we don’t just prepare you to react to a buyer’s QoE analysis; we use it proactively to strengthen your position. Our approach focuses on conducting a sell-side analysis that frames your practice’s financial story in the most compelling way possible.

We dive deep into your financials to uncover every legitimate adjustment that can increase your Adjusted EBITDA. The findings from this analysis become a cornerstone of the marketing materials we create, demonstrating your practice’s true value with verifiable data. This rigorous preparation is a key part of our comprehensive financial due diligence support, designed to put you in control of the negotiation.

A QoE analysis is an investment in a smoother, more predictable, and more profitable transaction. It moves your valuation from an opinion to a data-backed fact, giving you the leverage to close the best possible deal.

Ready to uncover the true, defensible value of your practice? Contact the SovDoc team for a confidential consultation.

Frequently Asked Questions

What is a Quality of Earnings (QoE) analysis and why is it important when selling a healthcare practice?

A Quality of Earnings (QoE) analysis is a forensic financial review that validates the true earning power of a healthcare practice for a potential buyer. It goes beyond the standard profit and loss statements by assessing future sustainable cash flow, differentiating recurring profits from one-time events and owner-specific expenses. This analysis is essential in healthcare M&A because it establishes the Adjusted EBITDA figure that determines the entire deal value, ensuring a fair and smooth transaction.

How does a QoE analysis differ from a standard financial audit?

Unlike a standard audit that verifies historical accuracy and compliance with GAAP, a QoE analysis is forward-looking and focuses on assessing the practice’s future earnings sustainability and risks. An audit confirms the accuracy of past financial statements, while a QoE analysis identifies true normalized cash flows and potential risks from the perspective of an M&A buyer or investor. This distinction makes QoE a critical tool for buyers and sellers during practice transactions.

What key financial components are examined in a QoE analysis of a medical practice?

A QoE analysis scrutinizes several core components including:

– Revenue Sustainability and Payer Mix (distinguishing recurring vs. non-recurring revenue, payer concentration, and reimbursement rates)

– True Cost Structure and EBITDA Normalization (adjusting owner-related expenses, owner compensation, and non-recurring costs)

– Accounts Receivable and Cash Flow Health (AR aging and collections velocity)

– Net Working Capital (establishing an appropriate target to cover near-term expenses post-sale)

What benefits does a QoE analysis provide to the seller of a healthcare practice?

For sellers, a QoE analysis protects valuation by identifying and documenting all legitimate add-backs upfront, preventing buyers from lowering the price during diligence. It increases credibility by showing transparency and seriousness, attracting premium buyers. Additionally, it speeds up the transaction process by addressing buyer questions early, reducing due diligence time and deal fatigue.

How can a seller proactively use a QoE analysis to maximize the value of their healthcare practice?

Sellers can use a sell-side QoE analysis to control their financial narrative by uncovering every legitimate adjustment that increases Adjusted EBITDA. The verified findings from the analysis become central to marketing materials, demonstrating the practice’s true value with credible data. Proactive QoE preparation ensures a smoother, more predictable transaction and positions the seller to negotiate from a place of strength for the best deal possible.