In today’s competitive healthcare market, technology decisions are directly linked to financial performance and strategic value. Understanding the practice management automation landscape is no longer just an operational concern—it is a critical component of profitability and M&A readiness

This guide examines the leading automation tools through an M&A lens, focusing on the scalability, integration, and value creation that matters most in a transaction.

Why Practice Management Automation is Critical for Valuation

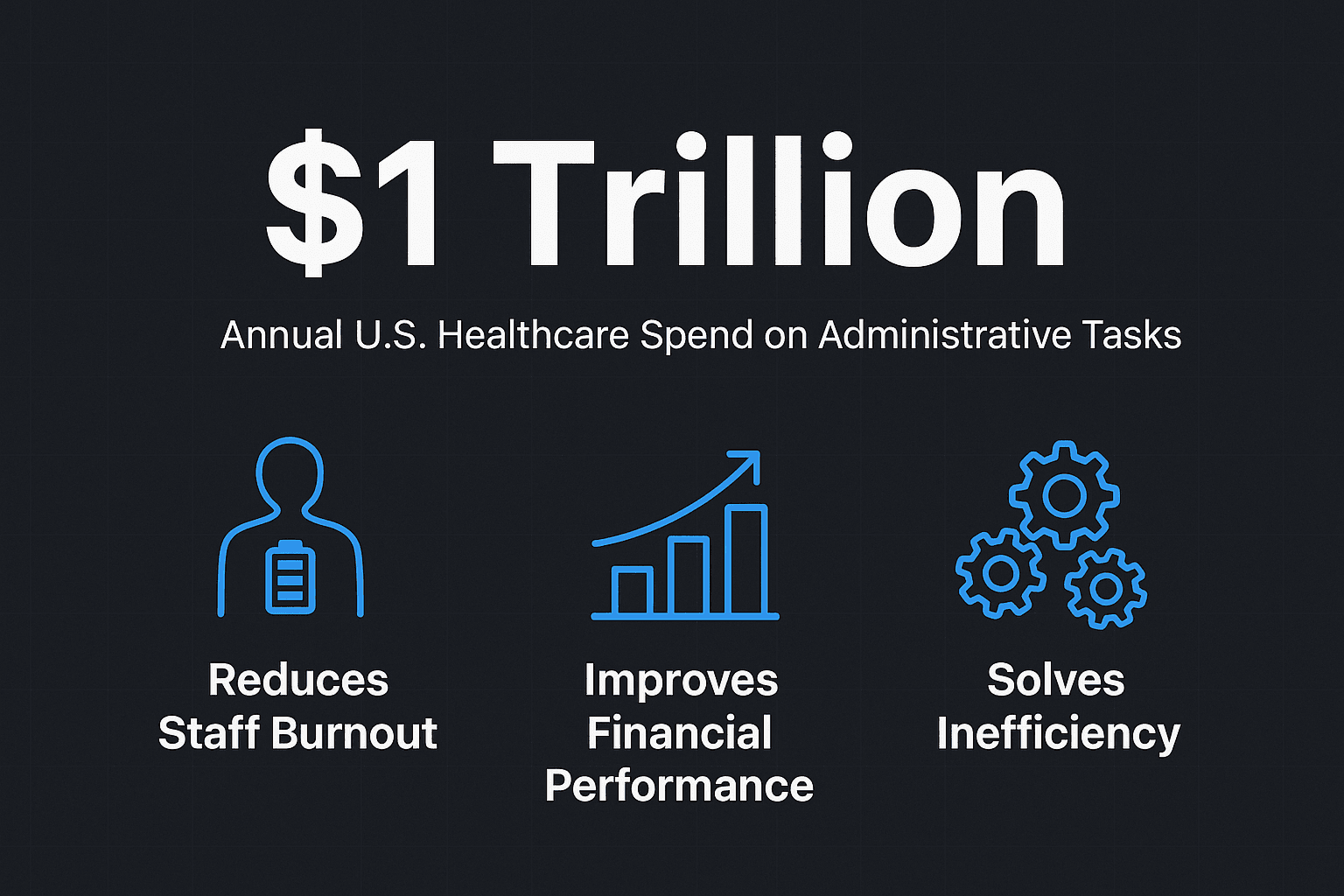

Administrative chores consume nearly a trillion dollars of the U.S. healthcare spend annually, creating a significant drag on profitability and contributing to staff burnout. While Practice Management software automates tasks from scheduling to billing, its true value lies in the strategic advantages it creates.

Robust automation delivers clear benefits that are highly attractive to buyers:

- Reduces Staff Burnout: Automating repetitive tasks helps combat high staff turnover, a critical risk factor in due diligence, and allows staff to focus on high-value, patient-facing activities.

- Improves Financial Performance: Organizations see measurable improvements in revenue cycle efficiency, which directly impacts the bottom line. In fact, 75% of the top 100 U.S. health systems already use automation in core business areas.

The Problem at Scale: Administrative tasks still absorb roughly a quarter of the United States’ $4 trillion annual healthcare spend—a massive operational inefficiency that automation is uniquely positioned to solve.

What are the Best Practice Management Tools for Large Health Systems?

For enterprise-level organizations managing complex, multi-location operations, two solutions dominate the landscape due to their comprehensive nature and proven scalability.

- Epic Systems

- Best For: Large, integrated health systems.

- Key Strengths: The gold standard for comprehensive workflow automation across all clinical and administrative processes. Integrates advanced AI and predictive analytics into revenue cycle management.

- Strategic Consideration: Epic implementations often command premium valuations, but require significant investment (often over $300K annually) and long deployment times.

- Cerner (Oracle Health)

- Best For: Hospitals and large practice networks focused on interoperability.

- Key Strengths: Robust clinical workflow automation and strong data-sharing capabilities, backed by Oracle’s powerful enterprise infrastructure.

- Strategic Consideration: Its technological sophistication is highly attractive to strategic buyers, but the high total cost of ownership is a key factor in due diligence.

What are the Best Practice Management Tools for Growing Practices?

Mid-market practices require a balance of sophisticated features and manageable implementation to maximize their value proposition for a future exit or expansion.

- AdvancedMD

- Best For: Multi-location practices planning for growth or a strategic exit.

- Key Strengths: A unified, cloud-native platform for practice management, EHR, patient engagement, and revenue cycle management.

- Strategic Consideration: Its end-to-end automation suite is highly attractive for demonstrating operational maturity, making it a strong fit for healthcare roll-up strategies.

- Tebra (formerly Kareo)

- Best For: Independent practices seeking to prove operational excellence.

- Key Strengths: Uses built-in AI and Robotic Process Automation (RPA) to automate notes, reviews, and administrative tasks.

- Strategic Consideration: Delivers concrete ROI metrics (e.g., reducing manual input by 33%) that strongly appeal to financial buyers. Tebra is often considered a top

- IT/EHR specialist for therapy practices.

- athenahealth

- Best For: Practices focused on maximizing financial performance.

- Key Strengths: Specializes in revenue cycle optimization, helping practices submit cleaner claims and boost revenue visibility.

- Strategic Consideration: Its direct impact on EBITDA makes organizations more attractive to private equity buyers who prioritize measurable financial gains.

Practice Management Automation Tools Comparison Chart

| Solution | Best For | Starting Price | Key Automation Strengths | Strategic Value / M&A Angle |

| Epic | Large Health Systems | $300K+ annually | Comprehensive workflow automation, AI | Commands premium valuations due to deep integration. |

| Cerner/Oracle | Hospitals & Large Practices | $200K+ annually | Clinical workflow automation, population health | Strong strategic value for buyers seeking interoperability. |

| AdvancedMD | Multi-location Practices | $429/month | End-to-end automation, cloud-native | Proven high-value exit; attractive for roll-up strategies. |

| Tebra | Independent Practices | $299/month | AI-powered automation, RPA capabilities | Demonstrates clear ROI and operational efficiency for buyers. |

| athenahealth | Revenue Cycle Focus | $140/month | Financial automation, benchmarking | Directly improves EBITDA, attracting PE interest. |

| CERTIFY Health | Innovation-Focused | Custom pricing | Biometric automation, advanced integrations | Offers innovation premium for buyers seeking differentiation. |

| SimplePractice | Behavioral Health | $39/month | Specialty-specific automation, telehealth | High value in niche market consolidation. |

| Keragon | Healthcare-Specific Automation | $99/month | 300+ healthcare integrations, BAA included | Strong emerging player for custom workflow needs. |

| Workato | Enterprise Automation | $10K+ annually | Enterprise-grade workflows, 99.9% uptime | Preferred for enterprise-wide digital transformation. |

Automation Best Practices for Maximum Impact and HIPAA Compliance

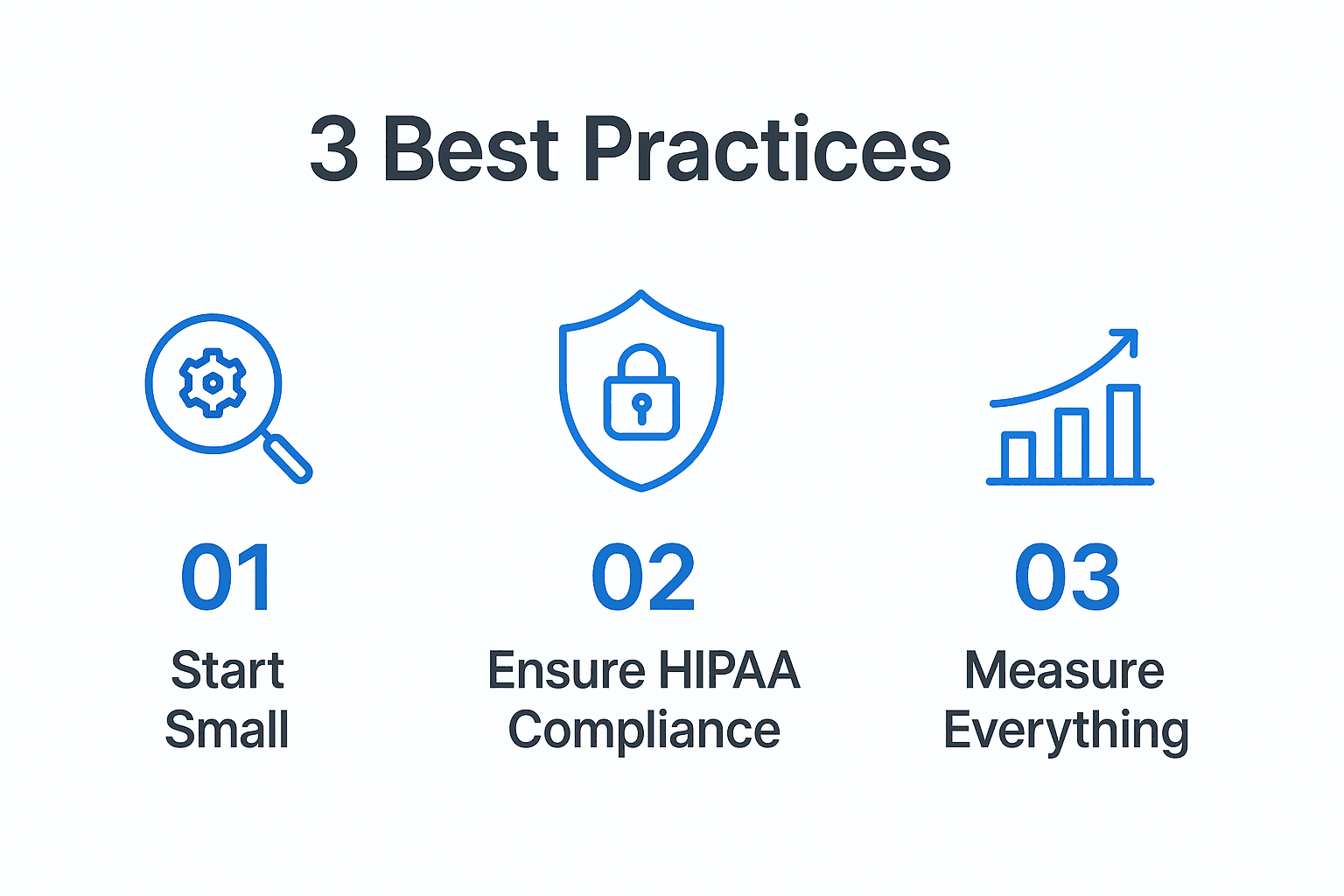

The most successful implementations follow a strategic approach to minimize risk while maximizing early wins.

- Start Small: Begin with high-impact, low-risk processes like patient intake, eligibility checks, or appointment reminders to demonstrate quick ROI.

- Ensure HIPAA Compliance: Any service touching electronic protected health information (ePHI) must satisfy HIPAA requirements. This is non-negotiable. Your vendor must provide a Business Associate Agreement (BAA), end-to-end encryption, and immutable audit logs. You can learn more in our guide to healthcare cybersecurity frameworks

- Measure Everything: Track key metrics to prove value. For example, successful pilot clinics using automation have reduced administrative time per new-patient packet from 15 minutes to under five minutes. These improvements directly boost revenue cycle performance through faster claims and fewer denials.

The Impact on Valuation: Based on industry analysis, technology-forward practices often achieve a 15-25% higher valuation in M&A transactions. Our practice value enhancement strategies guide explores this in more detail.

How Automation Drives a Higher Practice Valuation

A modern, well-integrated automation system is a clear signal to potential buyers that a practice is well-managed, scalable, and financially optimized. It demonstrates:

- Operational Excellence: Lower staff-to-provider ratios, higher productivity, and consistent quality measures.

- Financial Optimization: Better collection rates, fewer claim denials, and predictable revenue streams with higher EBITDA multiples.

- Strategic Positioning: A technology infrastructure that supports future growth, telehealth, and data analytics without a proportional increase in overhead.

Positioning for a Strategic Transaction

Choosing the right practice management automation platform is more than an operational decision—it’s a strategic move that can significantly enhance your organization’s value in a competitive M&A environment. The key is to select a solution that not only addresses current needs but also aligns with your long-term growth and strategic objectives.

If you are considering a strategic transaction, engaging with experienced advisors can provide critical insights into how technology capabilities impact valuations and help position your organization for maximum value.