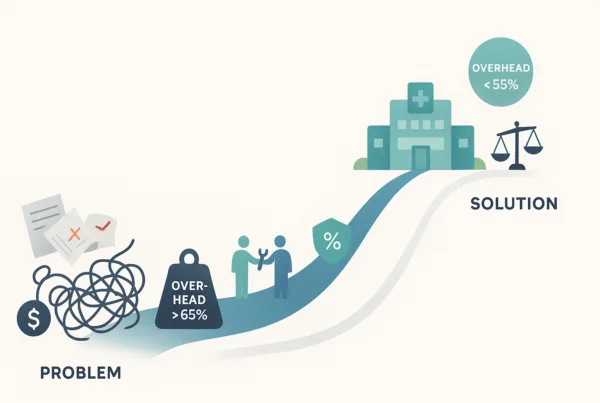

Imagine two medical practices in the same specialty, each generating $3 million in annual revenue. On the surface, they appear to be of equal value. Yet, one might sell for $2.5 million while the other commands a price of $4.5 million. What accounts for this massive difference? The answer often lies in one of the most critical and scrutinized metrics in healthcare M&A: payor mix.

Your payor mix is the percentage breakdown of your practice’s revenue by its source—commercial insurance, Medicare, Medicaid, and self-pay patients. To a sophisticated buyer, this mix tells a detailed story about your practice’s profitability, financial stability, and future risk. It’s a primary determinant of what your cash flow is truly worth.

As we covered in our complete guide to how payor mix affects practice value, this single factor can dramatically raise or lower your final sale price. Here, we’ll explore exactly how buyers analyze your payor mix and what you can do to position it for the highest possible valuation.

The Quantitative Impact: How Payor Mix Shapes Your Valuation Multiple

Private equity firms and strategic acquirers value predictable, high-margin cash flow. Because different payors reimburse for the same services at different rates, your payor mix directly determines your practice’s profitability and revenue quality. A practice heavily reliant on lower-paying government sources is seen as having lower-quality, riskier earnings than a practice dominated by high-reimbursement commercial contracts.

This assessment translates directly into the EBITDA multiple a buyer is willing to offer. Based on current market data for 2025, the trend is clear.

| Payor Mix Composition | Typical Practice EBITDA Multiple (2023-2025) | Buyer’s Perspective |

|---|---|---|

| >60% Commercial | 7x – 9x EBITDA | Most attractive; higher margins, stable rates |

| 50% Commercial / 50% Medicare | 6x – 7x EBITDA | Industry average; stable but exposed to cuts |

| Majority Medicare | 5x – 6x EBITDA | Higher risk; concerns over reimbursement decline |

| >50% Medicaid | 4x – 5x EBITDA (or lower) | Highest risk; low rates, high administrative burden |

This table shows that a shift in payor mix can alter a practice’s enterprise value by millions of dollars, even if revenue remains constant. While these ranges provide a strong baseline, the final multiple is also influenced by other factors detailed in our analysis of valuation multiples by medical specialty.

A Buyer’s Perspective: Deconstructing Each Payor Type

To understand the multiples, you need to think like a buyer. Here’s how they view each slice of your revenue pie.

Commercial Insurance: The Gold Standard

Revenue from commercial payors is the most sought-after by acquirers.

* Why it’s valued: Commercial plans generally offer the highest reimbursement rates. These contracts are also perceived as more stable and less susceptible to sudden, politically driven cuts compared to government programs. A strong commercial base signals a healthy, profitable practice.

Medicare: The Predictable But Pressured Giant

Medicare is a foundational payor for many practices, especially in certain specialties and geographic areas.

* How it’s viewed: While Medicare provides a large and consistent patient base, buyers are wary of its long-term financial trajectory. They price in the risk of declining reimbursement rates, sequestration, and federal budget battles that could impact future profitability.

Medicaid: The High-Risk Payor

A heavy concentration of Medicaid patients is often the biggest red flag for buyers.

* Why it’s risky: Medicaid offers the lowest reimbursement rates, which severely compresses margins. It also comes with significant administrative complexity and is vulnerable to state-level budget cuts, making its revenue stream the least predictable.

Self-Pay: A Double-Edged Sword

The value of self-pay revenue depends entirely on its source.

* The “Good” Self-Pay: For elective, cosmetic, or concierge services, cash-pay revenue is extremely valuable. It’s high-margin and free from insurance company bureaucracy.

* The “Bad” Self-Pay: Revenue classified as “self-pay” because it comes from uninsured patients or patient responsibility after insurance is seen as a liability. Collection rates are notoriously low, and buyers will heavily discount this portion of your accounts receivable.

Beyond the Percentages: The Nuances Buyers Scrutinize

A top-level percentage breakdown is just the starting point. During due diligence, buyers will dig deeper into several nuances that can affect the value of your payor mix.

- Concentration Risk: Do you rely on a single insurance plan for a large portion of your commercial revenue? If one contract with Blue Cross Blue Shield represents 40% of your total income, a buyer will see this as a major risk. The loss of that single contract could be catastrophic.

- Geographic & Demographic Trends: A practice might have a strong commercial mix today, but if it’s located in a county with a rapidly aging population, a buyer will project a future shift toward Medicare. They will factor this future risk into their current valuation.

- The Value-Based Care (VBC) Exception: If your practice has significant Medicare or Medicaid exposure but can demonstrate outstanding performance in VBC arrangements, this can help offset the risk. Proven success in managing patient populations to achieve quality outcomes and shared savings shows a level of sophistication that buyers may reward.

Acquirers will scrutinize all these details as part of their financial due diligence process to verify the true quality and sustainability of your practice’s earnings.

Proactive Strategies to Enhance Your Payor Mix for a Higher Sale Price

Improving your payor mix is not a quick fix; it’s a strategic initiative that can take 12 to 24 months to yield significant results. Starting this process well before a sale is one of the most effective ways to increase your practice’s value.

- Audit and Renegotiate Contracts: Don’t assume your current reimbursement rates are set in stone. Regularly review your contracts with major commercial payors. If you are being paid below market rates, or if you’ve added new services or providers, you may have leverage to renegotiate for better terms.

- Strategic Patient Acquisition: Analyze the demographics of your service area. Focus marketing efforts on attracting patients covered by higher-reimbursing commercial plans. This could mean targeted digital advertising, physician liaison outreach, or community engagement in specific zip codes.

- Analyze Service Line Profitability: Determine which of your services are most profitable based on your payor mix. Develop strategies to grow these well-reimbursed service lines while managing the growth of those that are less profitable.

- Track Your Data Rigorously: You cannot manage what you don’t measure. Implement practice management software that allows you to track key performance indicators, such as revenue per visit by payor. This data is essential for making informed strategic decisions and for benchmarking your practice’s financial performance against industry peers.

Integrating these tactics into a broader set of practice value enhancement strategies can lead to a substantially higher exit valuation.

How SovDoc Helps You Position Your Payor Mix for Maximum Value

Successfully analyzing, improving, and presenting your payor mix requires expertise. At SovDoc, this is a core component of our M&A advisory process.

- Pre-Sale Assessment: We conduct a deep dive into your payor data to identify strengths, weaknesses, and concentration risks long before your practice goes to market.

- Financial Modeling: Our PE-grade financial models don’t just use historical data. We project future performance based on payor mix trends and strategic initiatives, creating a defensible and compelling financial story.

- Narrative Development: We frame the narrative around your payor mix, highlighting its strengths and providing clear, data-backed mitigation for any perceived risks.

- Diligence Support: We help you prepare and organize the granular payor data that buyers will demand, ensuring you are ready for scrutiny and can maintain momentum through the diligence phase.

Your payor mix is more than just a number on a report; it’s a direct reflection of your practice’s health and future potential. A proactive and strategic approach to managing it can be the difference between a good outcome and a great one.

Ready to understand how your practice’s payor mix impacts its true value? Contact the SovDoc team for a confidential valuation consultation.

Frequently Asked Questions

What is payor mix and why is it important in medical practice valuation?

Payor mix refers to the percentage breakdown of a medical practice’s revenue by its sources such as commercial insurance, Medicare, Medicaid, and self-pay patients. It is crucial because it reflects profitability, financial stability, and risk in the eyes of buyers, thereby directly impacting the practice’s valuation and the EBITDA multiple offered.

How does the composition of a payor mix affect a medical practice’s EBITDA multiple?

The payor mix determines the quality and predictability of the practice’s cash flow, directly affecting the EBITDA multiple. For example, practices with >60% commercial insurance can achieve multiples of 7x to 9x EBITDA, while those with majority Medicaid may only command 4x to 5x EBITDA or lower. A higher commercial mix generally translates to a higher valuation due to better reimbursement rates and stability.

Are medical practices with a high percentage of government payors like Medicare or Medicaid unsellable?

No, practices with significant Medicare or Medicaid revenue are not unsellable but are viewed as higher risk by buyers. Medicare is seen as a stable but pressured payor, while Medicaid is considered higher risk due to low reimbursement rates and administrative complexity. However, strong performance in value-based care arrangements or strategic payor mix management can mitigate some risks and enhance value.

What strategies can medical practices use to improve their payor mix before selling?

Medical practices can improve payor mix by auditing and renegotiating commercial contracts, focusing patient acquisition efforts on higher-reimbursing commercial payors, analyzing and optimizing service line profitability, and rigorously tracking payor revenue data. These initiatives, taken as part of a long-term strategy, can increase valuation multiples and overall sale price.

How does SovDoc assist medical practices with payor mix optimization for a successful sale?

SovDoc provides expert M&A advisory services, including a pre-sale assessment of payor data, financial modeling to project future performance based on payor mix trends, narrative development to highlight strengths and mitigate risks, and diligence support to prepare detailed payor information for buyers. This comprehensive approach helps maximize the practice’s value by effectively managing and presenting its payor mix.