As a practice owner, you know that strategic staffing is key to growth. But how you integrate Advanced Practice Providers (APPs) is a critical decision that directly impacts your revenue, compliance risk, and the ultimate valuation of your practice.

Many owners don’t realize that their APP integration model is a core component of their business strategy. Choosing the right framework can unlock new revenue streams and increase efficiency. Choosing the wrong one can expose you to costly audits and devalue your practice in the eyes of a potential buyer.

Strategic Insight: Your APP integration model is a critical decision that directly impacts revenue, compliance, and your practice’s valuation.

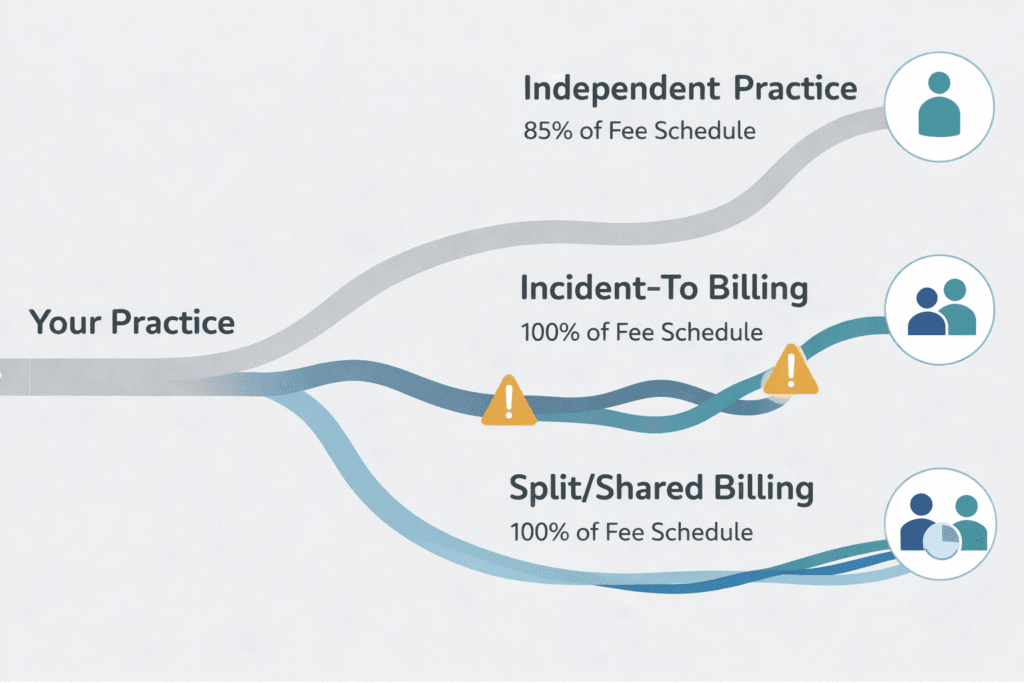

Let’s analyze the three primary APP integration models so you can determine which one is the right strategic fit for your practice.

What Are the Core APP Integration Models?

An integration model is the playbook that defines how your physicians and APPs collaborate. It dictates patient allocation, billing procedures, and daily workflows. This is a financial and compliance framework that shapes your practice’s performance and attractiveness to future investors or acquirers.

The model you choose determines whether you can bill at 100% of the physician fee schedule or 85%, and it defines the documentation required to defend your practice against audits.

To simplify your decision, we can compare the three main models across the factors that matter most to a practice owner: reimbursement, requirements, and risk.

| Integration Model | Reimbursement Rate | Key Requirement | Best Use Case |

|---|---|---|---|

| Independent Practice | 85% of Physician Fee Schedule | APP manages their own patient panel and bills under their own NPI. | High-volumeprimary care; states with full practice authority. |

| Incident-To Billing | 100% of Physician Fee Schedule | Physicians must be physically present in the office suite; for established patients with an existing treatment plan. | Office-based follow-up care and chronic disease management. |

| Split/Shared Billing | 100% of Physician Fee Schedule | The provider who performs the “substantive portion” (more than half the time) bills for the service. | Facility settings only (e.g., hospitals, outpatient departments). |

Analyzing the Strategic Fit of Each Model

The Independent Practice Model: Building a Scalable Team

In this model, APPs operate with significant autonomy, managing their own patient panels and billing directly under their own NPI. While the 85% reimbursement rate may seem like a drawback, the strategic value lies in scalability. By empowering APPs to handle routine and lower-acuity care, you free up your physicians to focus exclusively on complex cases and procedures that command higher reimbursement. This division of labor increases overall patient volume, creating a sustainable revenue engine that more than compensates for the 15% rate difference. From a valuation standpoint, this model is attractive to buyers because it demonstrates a scalable, compliant, and efficient operational structure.

Incident-To Billing: Maximizing Revenue with High Compliance Risk

The 100% reimbursement of the Incident-To model is tempting, making it ideal for managing follow-up care for established patients. However, its strict requirements, including the physician’s physical presence in the office suite for an established patient’s existing treatment plan, create significant compliance risks.

Compliance Alert: The “physician on-site” rule for Incident-To billing is non-negotiable. If the physician steps out for lunch or leaves for the day, you cannot bill Incident-To for services performed during their absence. Documentation must prove their immediate availability.

Auditors heavily scrutinize this model, and a single misstep can trigger audits and financial penalties. If you use this model, meticulous documentation is non-negotiable. For a potential buyer, a practice that uses Incident-To correctly shows financial savvy, but any sign of weak compliance is a major red flag.

Split/Shared Billing: A Team Approach for Facility Settings

This model is designed for facility settings like hospitals, where a physician and an APP from the same group both see a patient on the same day. Following the 2024 rule changes, the service must be billed by the provider who spent the substantive portion, more than half of the total time with the patient. This model is under intense regulatory focus, evidenced by recent multi-million dollar settlements against health systems for improper use. If your practice operates in a hospital, using this model is often necessary, but it demands airtight documentation that clearly delineates the time spent by each provider to withstand regulatory scrutiny.

How Does Your APP Strategy Impact Practice Valuation?

When preparing for a sale or partnership, your APP integration strategy will be a key area of due diligence. Buyers and investors are looking for:

- Sustainable Revenue: They will analyze whether your revenue model is dependent on specific individuals or if it’s built on a scalable system.

- Clean Compliance: Any ambiguity in your billing practices, especially around Incident-To or Split/Shared models, creates perceived risk. A clean compliance record is a significant asset.

- Operational Efficiency: A practice where physicians and APPs have clearly defined roles and work together seamlessly is more valuable than one marked by confusion or friction.

- Provider Retention: High APP turnover is a red flag that points to issues with compensation, culture, or role clarity. Stable, high-functioning teams are a hallmark of a well-managed practice.

From a Buyer’s Perspective: A well-integrated APP team signals a scalable and sustainable business. Unclear roles and compliance risks are major red flags that can significantly devalue your practice during due diligence.

Are You Optimizing Your Current APP Team?

If you feel your current APP integration isn’t delivering its full potential, focus on these areas for immediate improvement:

First, conduct a billing and documentation audit. Many practices either leave money on the table by under-billing or expose themselves to risk by billing for services that don’t meet strict criteria. Verifying that your billing aligns with your documentation is a critical first step.

Next, formalize and clarify roles. Document exactly what APPs are expected to handle independently versus what requires physician collaboration. Clear protocols reduce inefficiency and improve provider satisfaction. This clarity is essential for demonstrating a well-run operation during due diligence.

Finally, ensure your documentation and workflows are built for compliance and efficiency. Investing in training on proper documentation for models like Incident-To or Split/Shared protects your revenue and reduces risk.

The Future is Integrated

With a projected shortage of over 124,000 physicians by 2034, effective APP integration is no longer optional, it is a strategic necessity for survival and growth. Practices that proactively build compliant, efficient, and scalable APP models will not only thrive but will also command a higher valuation upon exit.

Getting your APP integration right creates a powerful strategic asset. It strengthens revenue, improves patient access, and minimizes compliance risk, positioning your practice as a leader in the market.

Understanding how operational decisions like APP integration affect your practice’s valuation is the first step toward a successful exit. The M&A advisors at SovDoc specialize in helping practice owners navigate these complexities to achieve a premium valuation.