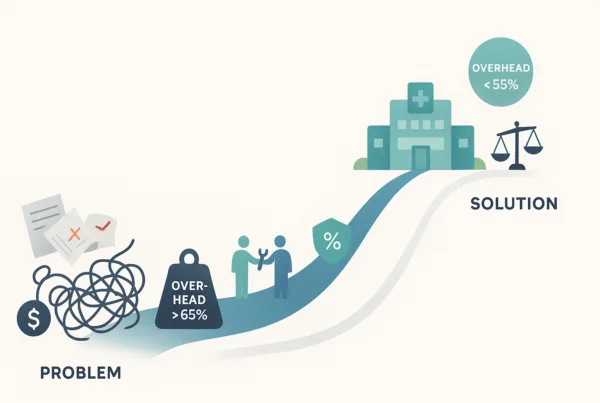

Most practice owners have a gut feeling about what their business is worth—a number shaped by years of hard work and investment. But when you prepare for a sale, sophisticated buyers like private equity firms and strategic acquirers leave feelings aside. They rely on cold, hard data, comparing your practice against established industry benchmarks.

Benchmarking is the process of measuring your practice’s performance against these standards. It’s a health check that shows you exactly where you stand, what you can celebrate, and what you need to fix before a buyer finds it for you. This process is a foundational part of determining your practice’s true market price, as we discuss in our Complete Guide to Healthcare Practice Valuation.

The Core Financial & Operational Benchmarks Buyers Scrutinize

A buyer’s first impression of your practice will be formed by a handful of key performance indicators (KPIs). Understanding these metrics helps you see your practice through their eyes.

Profitability Metrics

Profitability demonstrates the fundamental financial health and cash-generating power of your practice.

- EBITDA Margin: This is your Earnings Before Interest, Taxes, Depreciation, and Amortization, expressed as a percentage of net revenue. It shows how efficiently your practice converts revenue into profit. For well-run primary care and specialty groups, a healthy EBITDA margin is between 10% and 20%. Practices that sustain margins above this range often command premium valuations.

- Net Revenue per Physician: This KPI measures the productivity of your providers. While it varies significantly by specialty, national averages often fall between $500,000 and $1,000,000+ per physician. A strong figure here indicates an efficient and productive clinical team.

Operational Efficiency Metrics

These metrics reveal how well your practice manages its daily operations and converts activity into cash.

- Days in Accounts Receivable (A/R): This measures the average number of days it takes to collect payments due to the practice. It’s a direct indicator of your revenue cycle efficiency. Best-in-class practices keep their Days in A/R below 35 days, while the median is closer to 40–45 days. High A/R can signal collection problems to a buyer.

- Patient Volume Growth: A steady, predictable increase in patient volume shows that your practice is healthy and scalable. Annual growth of 5% to 10% is a strong signal to buyers that the practice has a sustainable future.

Strategic & Structural Metrics

These benchmarks reflect the long-term stability and strategic positioning of your practice.

- Payer Mix: The composition of your payers has a direct and significant effect on your final sale price. Since commercial plans typically reimburse at higher rates, buyers prefer a healthy mix. Practices with less than 50% of revenue from Medicare/Medicaid are generally viewed more favorably. You can learn more in our detailed guide on the impact of payer mix on valuation.

- Physician Compensation-to-Revenue Ratio: Buyers look closely at provider compensation to ensure it’s sustainable. A common target for physician-owners is to have compensation costs (including benefits) represent 40% to 50% of gross collections. A ratio far outside this range may require adjustment during valuation.

| Metric | Benchmark Range (2024–2025) | What It Tells a Buyer |

|---|---|---|

| EBITDA Margin | 10%–20% | Your practice’s core profitability and efficiency. |

| Days in A/R | < 35 (best), 40–45 (median) | Your ability to convert services into cash quickly. |

| Payer Mix | < 50% Medicare/Medicaid | Your revenue quality and sustainability. |

| Compensation Ratio | 40%–50% of revenue | Your cost structure is sustainable post-acquisition. |

| Patient Volume Growth | 5%–10% annually | Your practice is healthy and scalable. |

A Practical Guide: How to Benchmark Your Practice in 4 Steps

This exercise doesn’t require a team of accountants. You can get a clear picture with a focused effort and the right documents.

Step 1: Gather the Right Financial Documents

Before you can analyze your numbers, you need to collect them. Pull together the following for the last three years:

* Profit & Loss (P&L) statements

* Balance sheets

* Accounts receivable aging reports

* Physician productivity and compensation reports

* Payer mix summaries showing revenue by insurance provider

Step 2: Normalize Your Earnings for a True Comparison

Your P&L statement likely includes owner-related expenses (like personal car leases) or one-time costs (like a legal settlement) that a new owner wouldn’t incur. You must “add back” these items to calculate an Adjusted EBITDA. You also need to adjust owner compensation to a fair market rate.

This process of creating a clean, buyer-focused view of your earnings is essential. For a deeper look, see our EBITDA Normalization Guide for Healthcare.

Step 3: Map Your Numbers Against the Benchmarks

Create your own version of the table above. Go through your reports and calculate your practice’s figures for each metric. Place your numbers side-by-side with the industry benchmarks. This simple act creates an objective snapshot of your practice’s performance.

Step 4: Identify Your Strengths and Weaknesses

Review your completed table. Where do you excel? Perhaps your A/R is exceptionally low or your EBITDA margin is above 20%. These are the pillars of your value story.

Where do you fall short? Maybe your patient growth has been flat, or your reliance on Medicare is too high. These are not deal-breakers; they are your pre-sale punch list—the areas to focus on improving before you ever speak to a buyer.

Your Benchmarks Are In. Now What?

Completing this analysis gives you a powerful strategic advantage. How you use this information depends on what you find.

- If you exceed benchmarks: Congratulations. You have a premium asset. Your focus should be on preparing marketing materials that clearly and professionally showcase these strengths to attract top-tier buyers and drive a competitive sale process.

- If you meet benchmarks: Your practice is a solid, attractive acquisition target. The key to maximizing your value will be running a structured M&A process that creates competitive tension among multiple interested buyers.

- If you fall short: This is not bad news; it’s an opportunity. Identifying these gaps now—months or even years before a sale—gives you time to fix them. A targeted effort to lower A/R or renegotiate a payer contract can add significant value to your practice.

Addressing these gaps before a sale is one of the highest-ROI activities an owner can undertake. We cover specific tactics in our guide to Practice Value Enhancement Strategies.

From Benchmarks to a Better Valuation

Benchmarking transforms your valuation from a guessing game into a strategic exercise. It provides a clear, data-driven roadmap for understanding what your practice is worth today and how you can make it worth more tomorrow.

By seeing your practice through a buyer’s lens, you replace uncertainty with clarity. You gain the power to control your financial narrative, highlight your strengths, and proactively address weaknesses, putting you in the driver’s seat during any transaction.

Ready to see how your practice truly stacks up? Contact our team for a confidential analysis and move from self-assessment to strategic execution.

Frequently Asked Questions

What are the key financial benchmarks to track when selling a medical practice?

When selling a medical practice, key financial benchmarks include the EBITDA margin (typically 10-20%), net revenue per physician ($500,000 to $1,000,000+), Days in Accounts Receivable (ideally below 35 days), payer mix (less than 50% Medicare/Medicaid preferred), and the physician compensation-to-revenue ratio (around 40-50%). These metrics help buyers assess profitability, operational efficiency, and strategic positioning.

How can I benchmark my medical practice’s financials before putting it up for sale?

To benchmark your practice, follow these four steps:

1. Gather financial documents such as P&L statements, balance sheets, and A/R aging reports.

2. Normalize your earnings by adjusting for owner-related expenses and one-time costs.

3. Map your numbers against industry benchmarks using a comparison table.

4. Identify strengths and weaknesses to understand where you excel and where improvement is needed before a sale.

Why is the payer mix important when valuing a healthcare practice for sale?

Payer mix is crucial because it affects the revenue quality and sustainability of your practice. Buyers prefer a strong commercial payer base since commercial insurance typically reimburses at higher rates than Medicare/Medicaid. Practices with less than 50% revenue from Medicare/Medicaid generally command higher valuations.

What should I do if my medical practice falls short of industry benchmarks before selling?

Falling short of benchmarks is an opportunity to improve your practice’s value. Identifying weaknesses before a sale allows you time to address issues such as reducing Days in Accounts Receivable or renegotiating payer contracts. Proactively fixing these gaps can significantly increase your sale price and buyer interest.

How do buyers use KPIs like EBITDA margin and Days in Accounts Receivable during valuation?

Buyers use KPIs like EBITDA margin to gauge your practice’s core profitability and operational efficiency. A margin between 10-20% is attractive. Days in Accounts Receivable indicate how quickly you collect payments; lower days suggest healthier cash flow. These metrics help buyers understand financial health and risk, influencing their valuation and offer.